Intel’s new CEO, Lip-Bu Tan, is taking bold steps to revive the struggling chipmaker. After being named CEO, Tan has quickly outlined a strategy that includes divesting non-core businesses and potentially exploring new areas like robotics. He has asked customers for “brutally honest” feedback as part of his effort to understand where Intel needs to improve.

Tan plans to keep Intel’s manufacturing business running while focusing on creating new products, including custom semiconductors, to better align with market demands. During his speech at Intel Vision 2025, he shared his vision for turning the company around after years of losing ground to competitors. The approach appears to be a mix of streamlining operations and pursuing strategic growth opportunities.

Intel’s transformation won’t happen overnight, but Tan’s leadership signals a significant shift in direction. His experience and direct approach might give Intel what Reuters called “the last best chance” to reclaim its position in the semiconductor industry. As Tan told employees, he’s confident they can turn the business around together.

Inside Intel’s Strategic Overhaul: What the CEO’s Plan Means for the Future

Intel’s newly appointed CEO Lip-Bu Tan isn’t wasting time. In a bold pivot to reclaim leadership in the semiconductor race, he’s launched a sweeping restructuring initiative that touches nearly every layer of the company—from management to manufacturing, to the very culture inside Intel’s labs.

The announcement, made during Intel Vision 2025 in Las Vegas, outlined a vision that embraces agility, innovation, and brutal honesty—three things Intel critics say the company’s been lacking for years.

A Back-to-Basics Approach with Modern Execution

Tan is pushing Intel to think less like a legacy giant and more like a startup. In his own words, the plan is to “streamline decision-making, eliminate bureaucratic dead weight, and focus deeply on our engineering roots.”

Here’s what that actually looks like in practice:

- Flattening the org chart – Middle management will be trimmed to reduce delays between engineering teams and executives.

- Focusing on core competencies – Non-core business units, especially underperforming or unrelated ventures, will be spun off or sold.

- Engineering empowerment – Engineers are being given greater creative control and autonomy to explore new technologies, especially in AI and fabrication.

- Direct customer feedback – Tan has openly invited customers to be “brutally honest,” aiming to rebuild trust with major partners.

Intel’s Focus Areas in 2025 and Beyond

Tan’s turnaround playbook centers around five major priorities:

| Focus Area | Description |

|---|---|

| Chip Manufacturing | Regain process leadership with advanced nodes (e.g., Intel 18A, 14A). |

| AI Acceleration | Invest in on-chip AI, especially for datacenter and edge applications. |

| Foundry Services (IFS) | Compete directly with TSMC by opening fabs to third-party customers. |

| Cost Optimization | Reduce operational overhead by 20% through restructuring. |

| Culture Transformation | Shift to an innovation-first, risk-tolerant culture. |

What’s Changing Culturally at Intel?

The most ambitious part of the overhaul isn’t technical—it’s cultural.

Tan spoke candidly about Intel’s internal stagnation, citing layers of management that slowed innovation and a fear of failure that stifled bold ideas. To fix this, he’s implementing a cultural reset with these goals:

- Encourage experimentation – Engineers will be rewarded for innovation, even if the result isn’t immediately successful.

- Reduce internal red tape – Approvals and reviews are being simplified to avoid decision paralysis.

- Collaboration over hierarchy – Teams will be encouraged to work horizontally across silos.

Which Units Are on the Chopping Block?

Tan hasn’t named all the divisions under review, but reports indicate that several underperforming areas may face cuts. Here’s what analysts are speculating:

| Business Unit | Status | Reason for Scrutiny |

|---|---|---|

| Intel Mobileye (Autonomous) | Under strategic review | Strong valuation, but may be better off spun out. |

| Intel NUC (Mini PCs) | Potential shutdown | Low volume, outside Intel’s new core focus. |

| Altera FPGA Business | Retained and expanded | Key to AI and datacenter growth. |

| Arc Graphics Division | Uncertain | Struggled with adoption and software support. |

Tan has said that every unit will have to prove its strategic value moving forward, and nothing is untouchable.

Reaction from Industry and Wall Street

While Wall Street remains cautiously optimistic, tech analysts say this is the most significant shift in Intel’s identity in over a decade. Investors saw a modest bump in Intel stock following the keynote, signaling confidence in Tan’s leadership.

“Lip-Bu Tan knows what it takes to compete in high-performance markets,” said Stacy Rasgon of Bernstein Research. “If anyone can drag Intel back into the race, it’s someone who understands both the business side and the engineering side deeply.”

Intel’s Roadmap Moving Forward

Tan also confirmed that Intel remains on schedule for several major milestones:

| Year | Roadmap Milestone | Details |

|---|---|---|

| 2025 | Intel 18A production ramp | Targets process leadership regain over TSMC. |

| 2025 | Gaudi 3 AI Accelerator launch | Compete directly with Nvidia and AMD in AI compute. |

| 2026 | Fully open Intel Foundry Services (IFS) | Position Intel as the No. 2 global foundry by revenue. |

| 2027 | First consumer products on Intel 14A node | Leapfrogging Samsung and catching up with TSMC. |

Final Word from Tan: “We Have to Earn Back Trust”

In a rare moment of corporate vulnerability, Tan ended his presentation with a message to Intel’s partners, investors, and employees: “We have to earn back trust—and we’ll do that by delivering results, not just promises.”

It’s a stark contrast to Intel’s tone of the past decade, and if Tan sticks to this new direction, it could be the beginning of a true renaissance for the chip giant.

Key Takeaways

- New CEO Lip-Bu Tan plans to divest non-core businesses while keeping manufacturing operations running.

- Intel will focus on developing custom semiconductors and may explore robotics as part of its turnaround strategy.

- Customer feedback and operational restructuring form the foundation of Tan’s approach to revitalizing the struggling chipmaker.

Strategic Direction and Leadership

Intel’s future hinges on new leadership and a clear strategic vision. CEO Lip-Bu Tan is implementing significant changes to refocus the chip giant on its core strengths while addressing years of manufacturing challenges.

CEO Lip-Bu Tan’s Vision for Intel

Lip-Bu Tan took the helm at Intel with a reputation for turnaround expertise from his successful tenure at Cadence Design Systems. His vision centers on making Intel an “engineering-focused company” again. This marks a shift from the previous management approach that many industry watchers felt had lost sight of Intel’s technical roots.

“Under my leadership, Intel will be an engineering-focused company,” Tan stated during the Intel Vision conference in Las Vegas. His plan emphasizes:

- Streamlining decision-making processes

- Reducing bureaucracy that slowed innovation

- Rebuilding Intel’s technical leadership position

- Focusing on customer needs rather than internal metrics

Tan brings a fresh Silicon Valley perspective to Intel, which had become increasingly insular over the years.

Organizational Changes and Focus Shift

Tan is restructuring Intel to become leaner and more agile. The most significant change is the plan to spin off non-core businesses, allowing the company to concentrate resources on its fundamental strengths in chip design and manufacturing.

Key organizational changes include:

- Flattening management hierarchy to speed decision-making

- Reducing middle management layers that former executives identified as problematic

- Creating more autonomy for engineering teams

- Establishing clear accountability for product development

The company is also shifting its market focus, prioritizing high-growth sectors like data center processors and AI acceleration chips where profit margins remain strong.

Investment in Innovation and R&D

Tan’s strategy places renewed emphasis on R&D investment in next-generation chip technologies. Despite financial pressures, Intel is protecting its innovation budget while cutting elsewhere.

The R&D focus includes:

- Advanced manufacturing processes to catch up with TSMC and Samsung

- New chip architectures optimized for AI workloads

- Energy-efficient computing solutions

- Technologies that leverage Intel’s integrated design and manufacturing advantage

Industry analysts note that while previous CEO Pat Gelsinger began this transformation, Tan is accelerating the pace of change with a more decisive approach to restructuring.

Operational and Market Strategy

Intel’s new CEO Lip-Bu Tan has developed a comprehensive plan to revitalize the company’s position in the semiconductor industry. His strategy focuses on manufacturing improvements, strengthening customer relationships, and implementing sound financial practices to restore investor confidence.

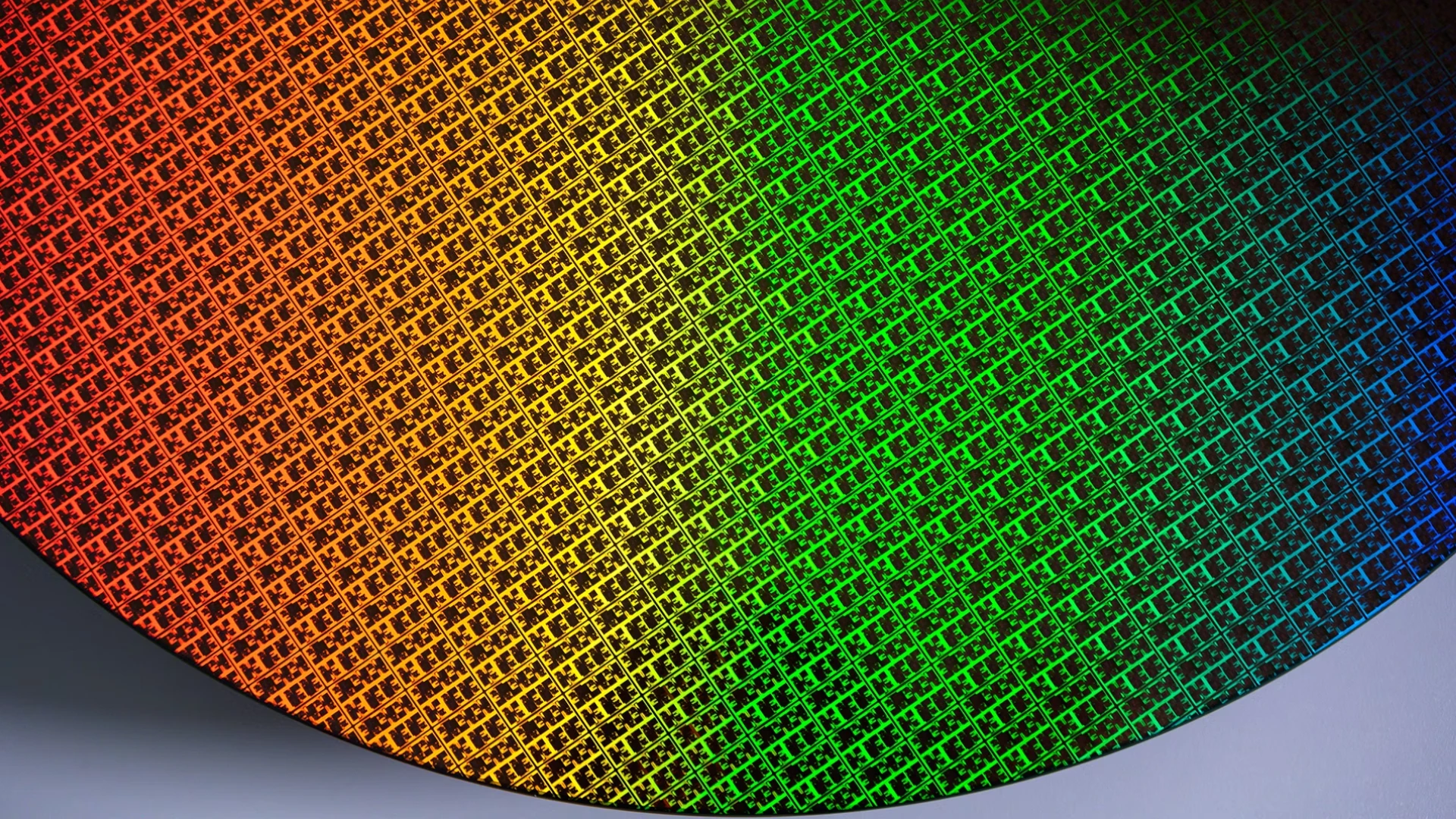

Enhancing Foundry Business and Manufacturing

Intel is planning significant changes to its chip manufacturing methods under Tan’s leadership. The company is prioritizing the development of its Intel Foundry business, positioning it to compete more effectively with other semiconductor manufacturers. Intel 18A, the company’s advanced manufacturing technology, stands at the center of this strategy.

The foundry business expansion represents a critical move to recapture technological leadership that Intel has lost in recent years. Tan is focusing on improving production efficiency and yield rates across manufacturing facilities.

Technical innovations in Intel’s manufacturing processes aim to address previous delays and quality issues that damaged the company’s reputation. The goal is to make Intel Foundry a reliable partner for both internal chip designs and external customers seeking cutting-edge manufacturing capabilities.

Market Action and Customer Relationships

Tan has requested “brutally honest” feedback from customers, signaling a cultural shift toward greater accountability and responsiveness. This approach aims to rebuild trust with key partners like Microsoft who have increasingly turned to other chip suppliers.

Intel faces strong competition from Nvidia in the AI chip market. Tan’s strategy includes refining Intel’s artificial intelligence offerings to better compete in this rapidly growing segment.

The company is reevaluating its product portfolio to ensure it meets evolving market demands. This includes potentially discontinuing underperforming product lines and investing more heavily in promising areas.

Customer relationships are being prioritized with more frequent interaction between Intel’s leadership and major clients. The goal is to ensure Intel’s roadmap aligns with customer needs rather than developing products in isolation.

Financial Strategies and Share Price Management

Tan plans to divest non-core businesses to free up resources and improve bandwidth for core operations. This strategy aims to streamline Intel’s structure and focus investment on areas with the greatest growth potential.

The share price (INTC) has faced significant pressure in recent years. Tan’s turnaround plan includes specific financial targets to restore investor confidence and improve stock performance.

Cost-cutting measures are being implemented across the organization. These efforts focus on eliminating redundancies without compromising the company’s innovation capabilities.

Investment priorities have been realigned to support the foundry business expansion and AI technology development. The financial strategy balances short-term profitability needs with long-term investments required to regain technological leadership in the semiconductor industry.

Frequently Asked Questions

Intel’s leadership changes and strategic pivots aim to address the company’s challenges in an increasingly competitive semiconductor market. These questions explore key aspects of Intel’s turnaround plans.

What strategies is the Intel CEO implementing to revive the company’s growth?

Intel’s CEO is focusing on engineering excellence as a cornerstone of the company’s revival. This marks a return to Intel’s roots as a technology innovator rather than just a business-focused organization.

The leadership team is pushing for more efficient execution of product development and manufacturing processes. This includes streamlining decision-making and improving time-to-market for new chip designs.

Intel is also investing heavily in manufacturing capabilities, especially through its IDM 2.0 strategy. This approach combines in-house production with strategic use of external foundries when necessary.

How will Intel address its competition and market challenges in the coming years?

Intel plans to regain technological leadership through advanced chip designs and manufacturing processes. The company aims to catch up with and eventually surpass competitors like TSMC and AMD.

The company is leveraging government support, including benefits from the CHIPS Act, to build new manufacturing facilities. This investment in domestic chip production aligns with national security interests and creates new jobs.

Intel is also forming strategic partnerships with other technology companies to strengthen its position in emerging markets like AI, autonomous vehicles, and edge computing.

What are the projected impacts of Intel’s turnaround efforts on its financial performance?

Analysts expect Intel’s financial results to remain challenging in the short term as the company invests in its transformation. The high costs of building new facilities and developing advanced technologies will impact immediate profitability.

However, long-term projections suggest improved revenue growth if Intel successfully executes its manufacturing strategy and regains market share in key segments.

Investors are being asked to be patient, as the turnaround is expected to take several years before showing significant financial benefits.

In what ways is Intel planning to innovate or diversify its product lines for future success?

Intel is expanding beyond its traditional CPU business into graphics processing units (GPUs), AI accelerators, and specialized chips for specific computing tasks.

The company is developing more energy-efficient processors to meet increasing demand for sustainable computing solutions in data centers and personal devices.

Intel’s investment in quantum computing research represents another avenue for long-term growth and technological leadership beyond conventional semiconductor technology.

What operational changes has the Intel CEO proposed to improve efficiency and profitability?

Intel’s leadership is implementing cost-cutting measures across the organization to redirect resources toward critical growth areas. This includes potential workforce reductions and elimination of underperforming business units.

The company is also adopting more agile development methodologies to speed up innovation cycles and respond more quickly to market changes.

Manufacturing operations are being modernized with advanced automation and process improvements to increase yield rates and reduce production costs.

How will Intel’s turnaround plan affect its position in the global semiconductor industry?

If successful, Intel’s turnaround could reestablish the company as a leading chip manufacturer globally, particularly in advanced process nodes where it has fallen behind.

The company’s investments in U.S.-based manufacturing facilities may help shift some of the semiconductor industry’s center of gravity back toward North America from its current concentration in Asia.

Intel’s revival would create a more competitive market environment, potentially accelerating innovation across the entire semiconductor ecosystem and offering customers more choices.