Rumors are spreading about China’s efforts to create its own Extreme Ultraviolet (EUV) lithography machines, which could potentially bypass restrictions on advanced semiconductor equipment. According to recent search results, China may begin trials of domestically developed EUV machines in the third quarter of this year. If successful, this would represent a significant challenge to ASML’s monopoly on EUV technology and potentially undermine export controls that have limited China’s access to cutting-edge chip manufacturing tools.

However, experts remain skeptical about China’s ability to develop competitive EUV technology in the near term. Multiple sources indicate that building an EUV lithography machine is extremely challenging, requiring integration of millions of separate components, specialized optics, and UV lamp systems. Dutch semiconductor giant ASML, currently the world’s only producer of EUV machines, has been banned from selling its most advanced equipment to China as part of broader export controls.

The situation has reportedly prompted Chinese companies like Huawei to explore alternative approaches. While China continues to purchase Deep Ultraviolet (DUV) parts from ASML to stockpile against worsening sanctions, the Netherlands recently stopped granting licenses for ASML to export certain advanced DUV systems to China, further restricting access to semiconductor manufacturing technology.

China’s Race to Break ASML’s Monopoly on EUV Lithography

For years, ASML has held an unshakable monopoly over extreme ultraviolet (EUV) lithography machines—the crown jewel of semiconductor manufacturing technology. These machines are responsible for producing the world’s most advanced computer chips, powering everything from smartphones to data centers. However, China’s determination to break free from reliance on foreign technology has fueled a homegrown effort that is closer than ever to bearing fruit. If successful, this could disrupt the global chipmaking industry and redraw the power dynamics of the tech world.

The Importance of EUV Lithography in Chip Manufacturing

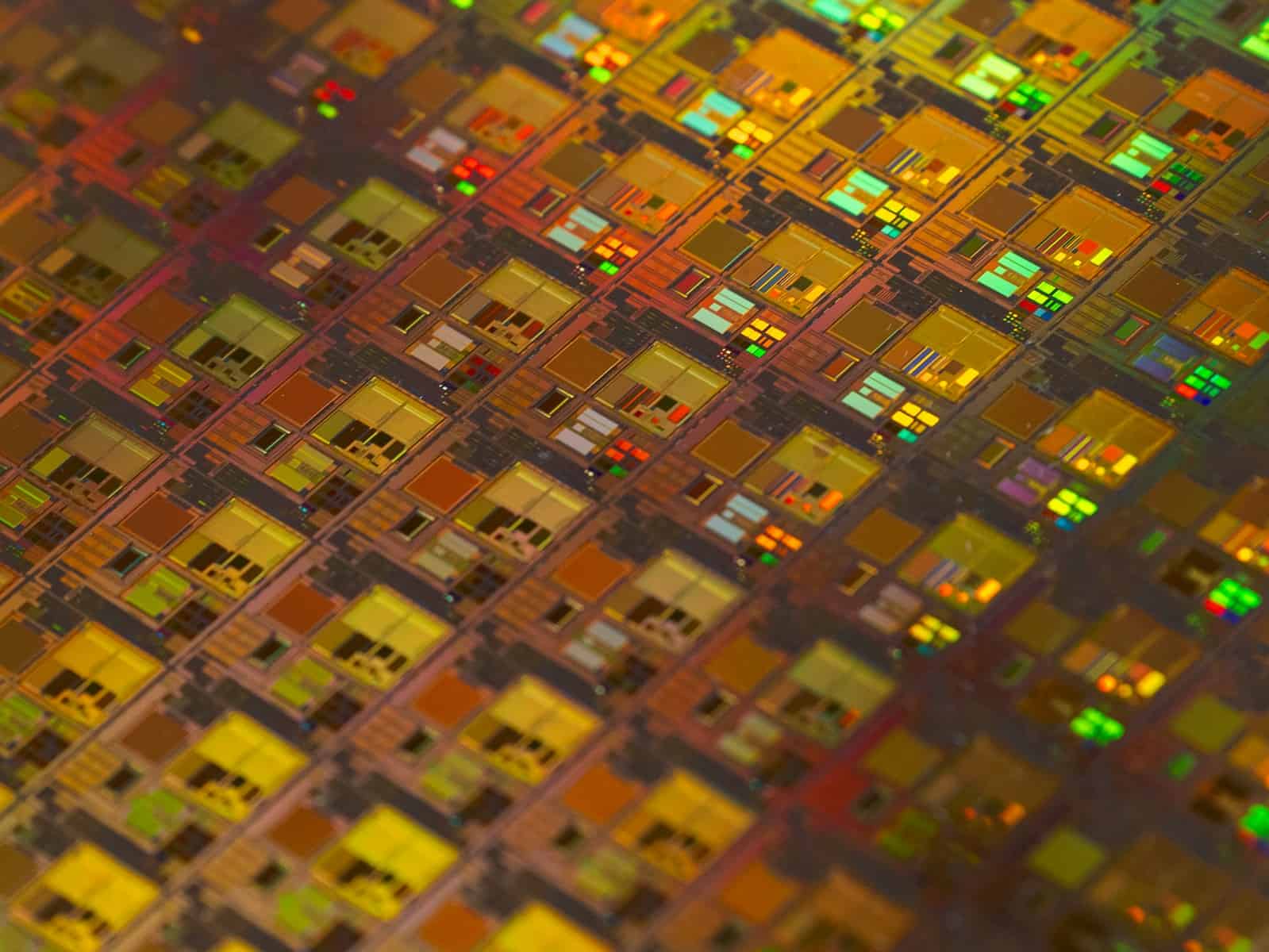

EUV lithography is essential for creating semiconductors at the most advanced process nodes—think 7nm, 5nm, and beyond. Unlike older deep ultraviolet (DUV) machines, EUV systems use light at a wavelength of just 13.5 nanometers. This allows for far more precise etching of silicon wafers, packing more transistors into the same chip space and leading to faster, more energy-efficient devices.

Currently, ASML is the sole provider of these machines, with each one costing upwards of $200 million. Countries like the U.S. and their allies have tightly controlled ASML’s exports to China, fearing they could boost Beijing’s technological and military capabilities. But China isn’t sitting still.

China’s EUV Development: Closer Than You Think

Reports suggest that China is on track to produce its first domestically made EUV machines by 2025, with mass production projected for 2026. One of the companies at the forefront of this effort is Shanghai Micro Electronics Equipment (SMEE). While SMEE currently lags behind ASML in terms of technological sophistication, they have reportedly made significant strides, filing patents that cover key aspects of EUV lithography systems.

Unlike ASML, which uses a complex laser-produced plasma (LPP) technique to generate EUV light, Chinese researchers are exploring an alternative called laser-induced discharge plasma (LDP). If successful, this approach could offer a simpler, more energy-efficient method of generating EUV light, potentially reducing costs and complexity.

Overcoming the Engineering Challenges

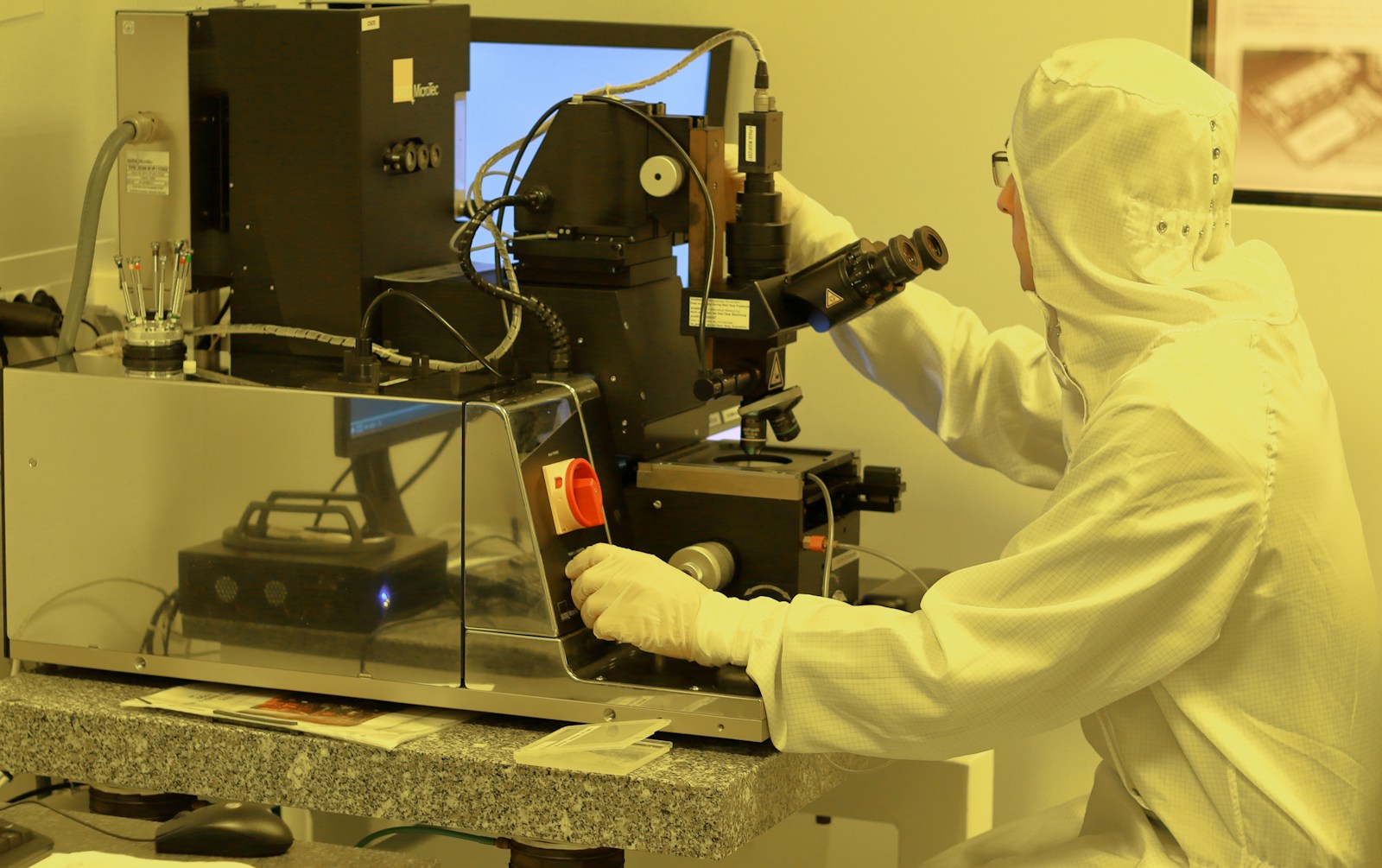

Creating an EUV system isn’t just about generating EUV light. The process involves some of the most complicated engineering ever attempted. You need highly sophisticated optics to focus the EUV light, a defect-free photomask, and an ultra-clean environment to prevent any contaminants from ruining the chips.

One of the biggest hurdles China faces is the precision optics. ASML relies on Zeiss, the German optics giant, to supply its ultra-precise mirrors. These mirrors have to be polished so flawlessly that any imperfections are smaller than the size of an atom. Replicating that capability domestically is a monumental task—but China has been investing heavily in its optics industry to bridge that gap.

The Geopolitical Implications

The West’s export controls have accelerated China’s push toward self-sufficiency. After the U.S. and Dutch governments blocked ASML from shipping its most advanced EUV tools to China, Beijing ramped up its investment in domestic chip manufacturing equipment. Estimates suggest China has funneled billions of dollars into developing its semiconductor supply chain.

If China succeeds in mass-producing its own EUV machines, it would fundamentally alter the balance of power in global semiconductor production. China could not only meet its internal demand but potentially export advanced chips to countries that are currently dependent on Western technologies.

What This Means for ASML and the Global Market

ASML’s monopoly on EUV lithography has been one of the key reasons it’s considered a linchpin in the semiconductor industry. The entry of a Chinese competitor, even if initially less advanced, could mark the beginning of a new era of competition.

For ASML, this might pressure them to innovate faster and lower prices to maintain their market share. For chipmakers outside China, more competition could mean access to alternative suppliers—although geopolitical tensions could complicate such relationships.

The Road Ahead

Despite the significant progress, China’s EUV machines aren’t expected to rival ASML’s state-of-the-art systems immediately. Industry experts believe there’s still a technological gap to close—possibly several years’ worth of refinement and scaling.

That said, history shows that China has a track record of catching up quickly once it cracks the initial technology barrier. Whether or not they will succeed in mass-producing EUV machines remains to be seen, but one thing is clear: ASML’s monopoly may not last forever.

Key Takeaways

- China reportedly plans to trial homegrown EUV machines in Q3 2025, potentially challenging ASML’s monopoly.

- Experts question China’s technical capability to develop functional EUV systems due to the complexity involving millions of components.

- Export controls have intensified with the Netherlands halting licenses for advanced DUV systems to China, pushing Chinese companies to seek alternatives.

China’s Advances in Semiconductor Technology

China has made significant strides in semiconductor technology in recent years, focusing heavily on developing its own extreme ultraviolet (EUV) lithography machines to bypass international restrictions and achieve tech independence.

Domestic Development of EUV Machines

Recent reports suggest that China is on track to produce its own EUV lithography machines, with trials potentially beginning as early as Q3 of this year. These machines are crucial for manufacturing advanced chips at 7nm nodes and below. Chinese R&D centers have prioritized this technology after ASML, the Dutch semiconductor equipment giant, was banned from selling its most advanced EUV machines to China.

Huawei is reportedly leading these development efforts. While ASML’s High-NA EUV tools cost approximately $380 million each, China appears willing to invest whatever necessary to achieve technological self-sufficiency.

Chinese researchers have dramatically increased their output of semiconductor-related research papers, indicating a strong push toward innovation in this field.

Impact on the Global Semiconductor Industry

China’s progress in EUV technology could significantly disrupt the current semiconductor landscape. If successful, Chinese manufacturers like Semiconductor Manufacturing International Corp (SMIC) would gain the ability to produce advanced chips without relying on foreign equipment.

This development would reduce China’s dependence on companies like Intel and Nvidia for high-performance chips. Some industry experts predict that China could have functional domestic EUV machines within the next five years.

The global chip supply chain would face major restructuring as Chinese manufacturers gain the capability to produce advanced chips at scale. Taiwan’s dominance in contract manufacturing might face its first serious challenge in decades.

ASML’s effective monopoly on advanced lithography equipment would end, potentially affecting its market position and stock value.

Implications for International Export Controls

Western countries, particularly the United States, have implemented strict export controls to limit China’s access to advanced semiconductor technology. China’s domestic EUV development represents a direct challenge to these restrictions.

If China succeeds in creating EUV machines that match or approach ASML’s capabilities, it would essentially nullify many of the current export controls. This development might prompt Western nations to reconsider their approach to technology restrictions.

ASML has recently expanded operations in Beijing with a facility to help Chinese customers reuse existing equipment more effectively. This move shows the complex balance between commercial interests and international security concerns.

The semiconductor industry might see increased competition for talent and resources as China pours investment into this strategic sector. This technological race has geopolitical implications beyond just the chip industry.

Strategic Significance and Potential Consequences

China’s domestic EUV machine development marks a turning point in global semiconductor production. This advancement could reshape technology supply chains and alter geopolitical power balances in the microprocessor industry.

Taiwan Semiconductor Manufacturing Company (TSMC) and Global Competition

TSMC currently dominates advanced chip manufacturing with its access to ASML’s EUV technology. China’s homegrown EUV machines would directly challenge this position. If Chinese manufacturers can produce 5nm or 3nm chips independently, TSMC’s market advantage could shrink significantly.

Companies like TSMC have built their business on technological exclusivity that China couldn’t match. This barrier is now at risk of falling. Taiwan’s economic security partly depends on its semiconductor leadership, with TSMC representing over 50% of the global foundry market.

Chinese chip manufacturing would likely focus first on domestic supply chains before competing globally. However, even this would reduce TSMC’s customer base and potentially affect its research funding for next-generation technologies.

The global semiconductor industry might see price pressures once China enters with competitive manufacturing capabilities.

Huawei and the Future of Chinese Tech Companies

Huawei stands to gain enormously from domestic EUV access. Cut off from advanced chips by US sanctions, Huawei has struggled to maintain its smartphone and 5G equipment businesses.

With indigenous EUV capability, Huawei could resume producing cutting-edge Kirin processors for its devices. This would revitalize not just Huawei but the entire Chinese tech ecosystem.

Other Chinese tech firms currently dependent on foreign semiconductors would gain supply chain security and cost advantages. Companies developing AI hardware, autonomous vehicles, and cloud services would accelerate their growth.

The Chinese government’s investment in Huawei and similar companies would likely increase once the technology proves viable. This creates a powerful feedback loop of investment and technological advancement.

Innovation in Artificial Intelligence and Nanotechnology

Advanced chipmaking capabilities directly impact AI development. Chinese AI research has been hampered by limited access to the most powerful chips.

Domestic EUV technology would enable Chinese companies to design and produce specialized AI accelerators and neural processing units. This could lead to breakthroughs in natural language processing, computer vision, and deep learning algorithms.

In nanotechnology, EUV lithography enables working at incredibly small scales. Chinese researchers could advance fields like quantum computing, molecular electronics, and nanomedicine with unrestricted access to this technology.

Universities and research institutions would gain from closer collaboration with domestic chip manufacturers. This integration of academic research and industrial application often drives innovation faster than either sector alone.

Frequently Asked Questions

The EUV lithography market continues to evolve with China working to develop its own technology while facing export restrictions from current market leader ASML.

Who are the competitors of ASML in the EUV lithography market?

ASML currently holds a near-monopoly in the EUV lithography machine market. The Dutch company is the only commercial manufacturer of these advanced tools.

Major semiconductor equipment makers like Nikon and Canon have explored EUV technology but haven’t launched competitive products. ASML’s years of research and massive investments have created significant barriers to entry.

Chinese companies are now attempting to enter this space, though they remain years behind ASML’s technological capabilities.

What progress has China made in developing an alternative to ASML’s EUV technology?

Chinese researchers have reportedly developed a new approach to EUV lithography that differs from ASML’s methods. Recent reports suggest Chinese-made EUV tools might begin trial production in the third quarter.

These developments follow years of investment after export restrictions prevented China from purchasing ASML’s most advanced machines.

Chinese academic institutions and semiconductor companies have collaborated on this project, though specific technical details remain limited.

How does China’s own EUV technology compare to that of ASML?

China’s EUV technology appears to be less advanced than ASML’s current offerings. ASML’s latest High-NA EUV tools cost approximately $380 million and represent the cutting edge of lithography technology.

Chinese alternatives likely can’t match ASML’s resolution or throughput capabilities yet. However, even less advanced EUV tools would still represent a significant advancement for China’s semiconductor industry.

The gap in performance remains substantial, though China’s goal may initially be technological independence rather than market leadership.

What implications does China’s ability to manufacture its own EUV machines have for the global semiconductor industry?

If successful, China’s domestic EUV capability would reduce its reliance on foreign technology for advanced chip production. This could potentially weaken the effectiveness of export controls aimed at limiting China’s semiconductor advancement.

Global supply chains might see further fragmentation as China develops parallel technologies. Competition could eventually lead to price reductions for EUV equipment, though this would take years to materialize.

Semiconductor manufacturers might gain an alternative supplier, though adoption would depend on the performance and reliability of Chinese tools.

Has China faced any restrictions in purchasing EUV machines from ASML?

Yes, China has faced significant restrictions. The Dutch government, under pressure from the United States, has blocked ASML from selling its advanced EUV machines to Chinese companies.

These restrictions are part of broader export controls aimed at limiting China’s access to cutting-edge semiconductor manufacturing technology. ASML’s CEO has confirmed that the company cannot sell its most advanced equipment to China.

The export restrictions have been a key motivation for China to develop its own domestic EUV capability.

What developments have Nikon made in response to China’s advancements in EUV lithography?

Nikon has not made specific responses to China’s EUV developments. The Japanese company continues to focus on less advanced DUV (deep ultraviolet) lithography tools rather than competing directly in the EUV market.

Nikon historically competed with ASML in earlier lithography generations but has not commercialized EUV technology. Their business strategy has focused on other semiconductor equipment segments and optical products.

Industry analysts don’t currently view Nikon as a significant player in the EUV space, regardless of China’s progress.