Managing money matters in a small business can be tough. Good accounting software helps track income, expenses, and taxes without the headache. The right accounting software for your small business can save time, reduce errors, and give you clear insights about your financial health.

Many small business owners struggle to pick the best accounting software from the many choices available. Options range from free accounting tools to paid systems with advanced features. Some programs are better for tiny businesses, while others work well for growing companies with more complex needs.

To help make your decision easier, we’ve ranked the top accounting software platforms for small businesses in 2025 based on features, flexibility, pricing, and overall value. Whether you’re a freelancer, a retail shop owner, or a fast-growing startup, there’s a solution here for you.

Ranking Table: Best Small Business Accounting Software of 2025

| Rank | Software Name | Price or Plan Info |

|---|---|---|

| 1 | QuickBooks Online | Multiple plans; free trial available |

| 2 | Xero | Starts at $29/month; free trial available |

| 3 | FreshBooks | Free 30-day trial; tiered pricing |

| 4 | Sage 50cloud | Tiered pricing; integrates with Office 365 |

| 5 | Wave | Free core features; charges for payments |

| 6 | Zoho Books | Free plan for <$50K revenue; paid tiers |

| 7 | Patriot Software | Free trial; affordable pricing |

| 8 | Sage Business Cloud Accounting | Flexible plans; focused on cloud access |

| 9 | Kashoo | One flat plan; includes all features |

| 10 | ZipBooks | Free and paid options available |

1. QuickBooks Online

QuickBooks Online remains the gold standard in small business accounting. With millions of users worldwide, it offers robust features like income/expense tracking, payroll add-ons, tax prep tools, inventory management, and bank syncing. Cloud-based and mobile-friendly, it’s suitable for both beginners and seasoned professionals.

Why it’s #1: It balances ease of use with deep functionality. Accountants love it, and small business owners can scale up their features as they grow.

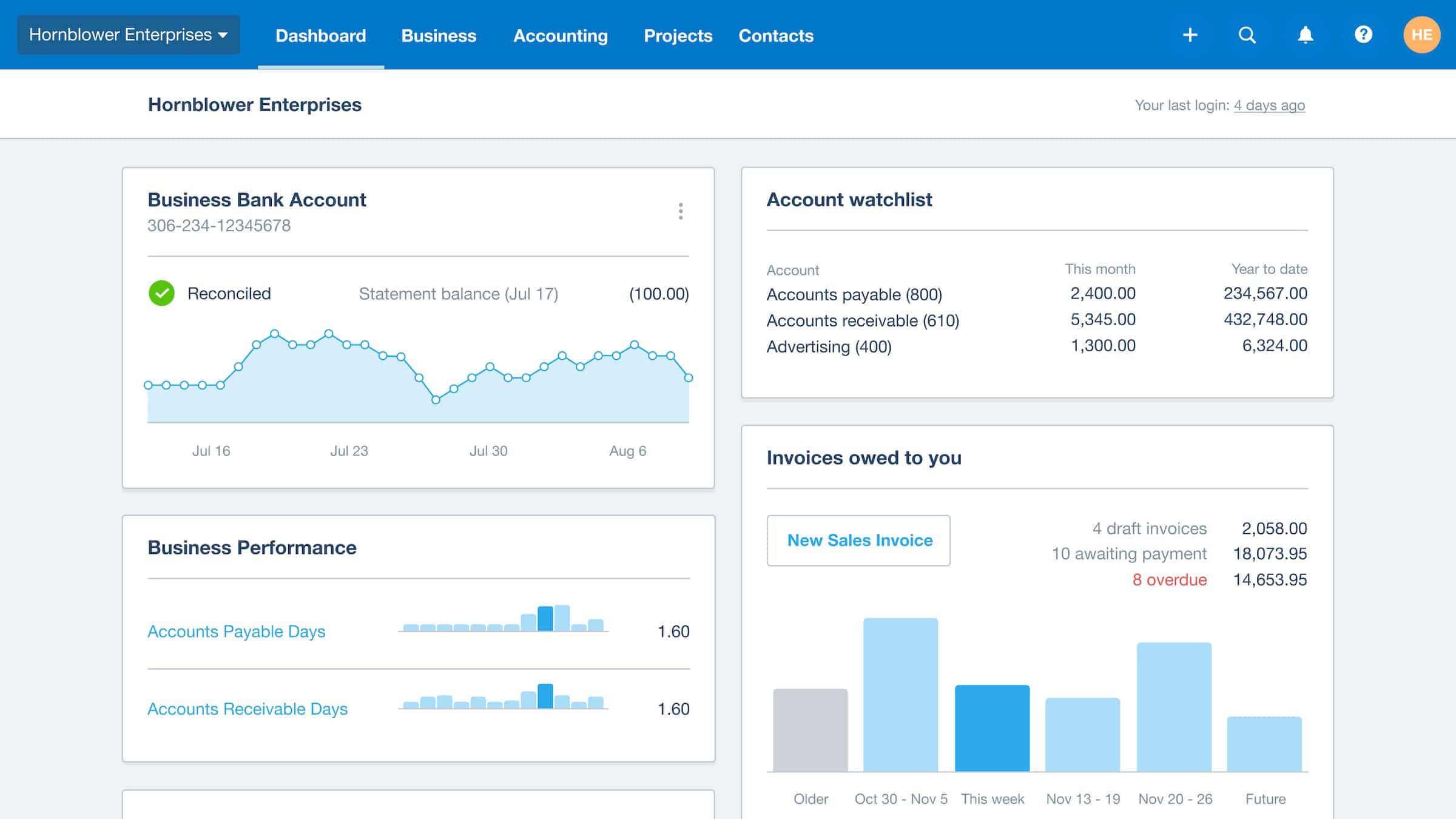

2. Xero

Xero shines for collaboration and real-time data access. It integrates with 1,000+ apps including PayPal, Shopify, and Gusto. It’s especially popular among businesses with remote teams or international transactions.

Key Advantage: Unlimited users at no extra cost—ideal for teams and bookkeepers who all need access.

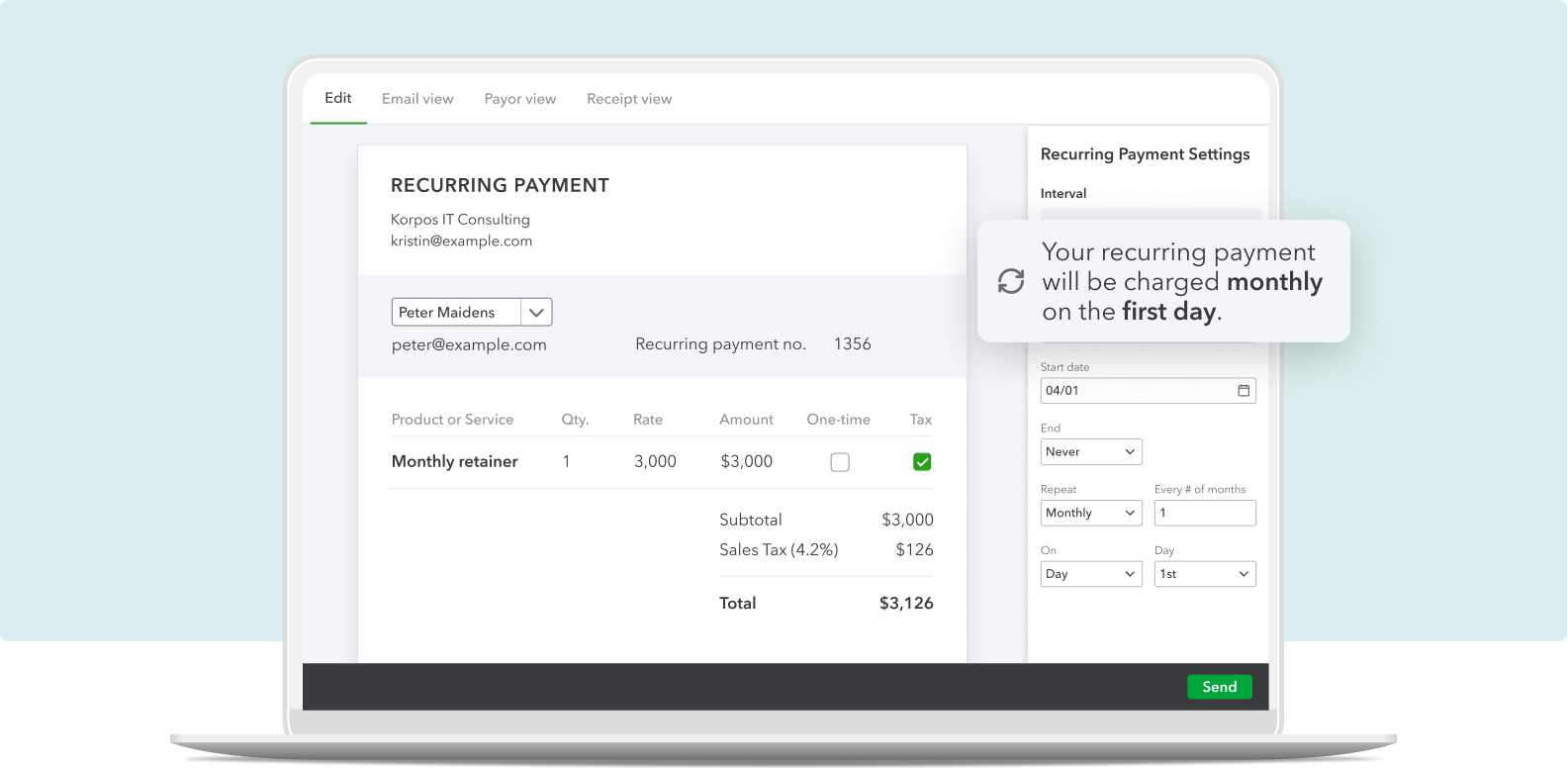

3. FreshBooks

Perfect for freelancers and service-based businesses, FreshBooks emphasizes invoicing, time tracking, and project-based billing. The interface is clean and intuitive, making it ideal for non-accountants.

Bonus Feature: Snap photos of receipts via mobile app and attach them directly to expenses.

4. Sage 50cloud

Sage 50cloud blends the security of desktop software with the flexibility of the cloud. It’s great for businesses that want advanced inventory management, job costing, and Microsoft Office 365 integration.

Best For: Companies transitioning from spreadsheets to full-scale accounting systems.

5. Wave

Wave is the best free accounting software for small businesses—hands down. While it lacks some advanced features and integrations, it covers all the basics like invoicing, expense tracking, and reporting.

Warning: Some users have raised concerns over its customer support and payment processing policies, so proceed carefully.

6. Zoho Books

Part of the larger Zoho ecosystem, Zoho Books is ideal for companies that already use Zoho for CRM, inventory, or HR. It automates tasks, handles multi-currency accounting, and includes excellent tax features.

Best For: Businesses under $50K revenue (free plan available) or those using other Zoho apps.

7. Patriot Software

Patriot is known for its simplicity and affordability. It’s especially strong in the payroll department, offering one of the highest-rated payroll systems among small business platforms.

Who Should Use It: Owners who want straightforward software without overpaying for features they won’t use.

8. Sage Business Cloud Accounting

Sage’s cloud-based product is designed for ease of use. While not as feature-rich as some competitors, it does a solid job handling everyday tasks like invoicing, transaction tracking, and reporting.

Noteworthy: Regular software updates ensure compliance with tax regulations.

9. Kashoo

Kashoo offers a single pricing plan with all features included, making budgeting simple. Its use of AI to categorize transactions and real-time bank feeds makes it ideal for solo entrepreneurs and very small teams.

Plus: Great multi-currency support and excellent customer service.

10. ZipBooks

ZipBooks is another freemium option with surprising power. Its time tracking, invoicing, and reporting tools are more than adequate for freelancers or small teams, with the option to scale up.

Unique Feature: Built-in intelligence tools help you gauge invoice quality and customer satisfaction.

What to Look For When Choosing Accounting Software

When evaluating which platform is best for your business, prioritize the following:

- Ease of Use: Look for an intuitive dashboard and mobile access.

- Scalability: Ensure the software grows with your company’s needs.

- Integration: Pick a tool that connects with your payment systems, CRM, or e-commerce platform.

- Automation: Automate recurring tasks like invoicing and expense tracking.

- Tax Readiness: Strong tax prep features can save you hours and prevent costly mistakes.

No matter the size or industry of your small business, the right accounting software can make a world of difference. Use the table above to compare your options and choose the one that fits both your current needs and your future goals.

Details On The Top Business Accounting Programs

Here is the full feature comparison table for the top small business accounting software of 2025:

| Software | Free Trial | Free Plan | Mobile App | Invoicing | Expense Tracking | Payroll Option | Integrations | Multi-Currency |

|---|---|---|---|---|---|---|---|---|

| QuickBooks Online | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Xero | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| FreshBooks | ✓ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Sage 50cloud | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Wave | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ |

| Zoho Books | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ |

| Patriot Software | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ |

| Sage Business Cloud | ✓ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Kashoo | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ |

| ZipBooks | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ |

1. QuickBooks Online

QuickBooks Online is the #1 accounting software for small businesses. Over 7 million small businesses trust this platform for their financial management needs.

QuickBooks Online offers a range of features that help small business owners handle their finances efficiently. You can track cash flow, prepare taxes, manage inventory, and record employee time—all in one place.

The software comes with a user-friendly interface that makes financial management less intimidating. Even if you’re not an accounting expert, you can navigate the platform with ease.

For small businesses looking for comprehensive accounting tools, QuickBooks Online stands out from competitors. Its features are designed to grow with your business.

QuickBooks offers several online plans to fit different business needs. Each plan includes core accounting features, with more advanced options available as you upgrade.

The setup process is quick and straightforward. You can get started right away and begin organizing your business finances without lengthy training.

One major advantage is the cloud-based nature of QuickBooks Online. You can access your financial data from anywhere, using any device with internet connection.

QuickBooks Online also connects with many other business apps. This integration helps streamline workflows between your accounting system and other tools you use daily.

When tax season arrives, QuickBooks makes preparation simpler. The software organizes your financial information in ways that make tax filing less stressful.

Small business owners can try QuickBooks Online for free before committing. This trial period lets you explore the features and see if they match your needs.

2. Xero

Xero is a powerful online accounting software for small businesses that helps owners take control of their finances. It lets you focus on running your business while keeping the numbers in check.

With Xero, you can manage cash flow and track expenses easily. The platform also allows you to accept payments online, which is handy for businesses that sell products or services remotely.

One of Xero’s big advantages is its flexibility for growing companies. Unlike some competitors, its pricing isn’t based on employee numbers, making it more cost-effective as your team expands.

The software connects you to your bank, accountant, and bookkeeper. This connection helps keep everyone on the same page about your finances.

Xero also works with many other business apps. This integration saves time by keeping all your important information in one place.

Plans start at $29 per month, and Xero offers a free trial. This gives you a chance to test the software before committing your money.

Small business owners often appreciate Xero’s user-friendly design. The interface is clean and makes finding what you need simple, even if you’re not an accounting expert.

For businesses looking for easy accounting software, Xero delivers with features that simplify complex financial tasks. The dashboard gives you a quick overview of your financial situation at a glance.

Mobile access lets you check your accounts, send invoices, or record expenses while on the go. This feature is particularly useful for business owners who travel or work from different locations.

Xero helps with tax preparation by organizing your financial information throughout the year. When tax time comes, you’ll have everything ready to go.

Customer support is available if you run into problems. This backing gives users confidence when learning to use the software.

3. FreshBooks

FreshBooks stands out as a top choice for small business accounting software. It’s designed with non-accountants in mind, making it accessible for business owners who don’t have financial expertise.

The platform offers custom invoicing tools that let businesses create professional-looking bills. Users can track time spent on projects, which is helpful for service-based businesses that bill by the hour.

Expense tracking comes built-in, allowing business owners to keep tabs on where their money goes. FreshBooks also accepts credit card payments, making it easier for customers to pay invoices quickly.

One of the platform’s best features is its cloud-based nature. Business owners can access their financial data from anywhere with an internet connection. This mobility suits entrepreneurs who work on the go.

FreshBooks offers a free 30-day trial for businesses wanting to test the service before committing. This trial period gives users full access to see if the software meets their needs.

The platform is particularly well-regarded for its invoicing capabilities. In fact, some business experts consider it the best small business invoicing software available today.

Beyond basic accounting, FreshBooks helps with receipt management. Users can snap photos of receipts with their phones and upload them directly to the platform, reducing paperwork.

The software scales with businesses as they grow. Whether a company has one employee or dozens, FreshBooks adjusts to changing needs without becoming overly complex.

FreshBooks competes with other accounting solutions like QuickBooks but maintains its appeal through simplicity and user-friendliness. Many small business owners find it less intimidating than other options.

The pricing structure is straightforward and affordable for most small businesses. This accessibility makes quality accounting software available to entrepreneurs with limited budgets.

4. Sage 50cloud

Sage 50cloud is a powerful accounting solution designed for small businesses. It combines traditional desktop accounting with cloud connectivity, giving businesses more flexibility in how they manage their finances.

This software makes it easy to create and track invoices, which helps small business owners stay on top of their cash flow. Users can also record transactions and accept payments directly through the system.

One standout feature of Sage 50cloud is its advanced inventory tracking capabilities. This makes it especially useful for retail businesses or any company that needs to keep close tabs on stock levels.

The financial tools in Sage 50cloud are comprehensive and go beyond basic bookkeeping. The system can handle everything from everyday accounting tasks to more complex financial reporting needs.

Small business owners appreciate how Sage 50cloud automates many administrative tasks. This automation frees up valuable time that can be better spent on growing the business.

Sage 50cloud offers different pricing plans to suit various business needs. Each plan includes core accounting features with additional capabilities available at higher tiers.

The software integrates with Microsoft Office 365, which enhances collaboration and makes it easier to work with financial data in familiar programs like Excel. This integration is particularly helpful for businesses already using the Microsoft ecosystem.

For businesses concerned about compliance, Sage 50cloud helps with tax preparation and reporting. The system keeps track of tax obligations and can generate the necessary reports when tax time comes around.

Small business owners find Sage 50cloud user-friendly despite its robust feature set. The interface is designed to be navigable even for those without extensive accounting knowledge.

Reviews note that Sage 50cloud is an exceptionally robust desktop accounting application with thorough reporting capabilities. This makes it suitable for businesses that have outgrown simpler accounting solutions.

5. Wave

Wave is a free accounting software designed for small businesses, freelancers, and creators. Unlike many competitors, Wave offers its core accounting features at no cost.

The platform combines invoicing, accounting, and payment processing in one place. Small business owners can create professional invoices with custom logos and send them directly to customers.

Wave’s mobile app lets users handle business tasks on the go. You can create estimates, send invoices, and check payment statuses from your phone.

The accounting features help track income and expenses automatically. The system organizes everything to make tax time less stressful.

However, some users have reported issues. On Reddit, one small business owner warned about problems with Wave’s accounting software, claiming the company took money from their business account unexpectedly.

Wave makes money through payment processing fees rather than subscription charges. They charge when customers pay invoices online through their system.

The software connects with bank accounts to import transactions automatically. This saves time on manual data entry and helps prevent bookkeeping mistakes.

Wave’s dashboard gives a quick overview of business finances. Users can see outstanding invoices, account balances, and profit and loss at a glance.

For businesses with simple accounting needs, Wave may be enough. More complex operations might need more robust software with advanced features.

The Wave Financial platform also offers receipt scanning through their mobile app. This feature helps track expenses by capturing receipts on the go.

Wave provides basic reports for business insights. These include profit and loss statements, balance sheets, and tax reports.

6. Zoho Books

Zoho Books is accounting software designed for small businesses that helps manage financial tasks efficiently. It offers tools for handling both receivables and payables while automating many routine accounting workflows.

Small business owners appreciate that Zoho Books streamlines bookkeeping tasks through its user-friendly interface. The platform stores your financial data securely in the cloud, making it accessible from anywhere.

One standout feature is its ability to connect with other Zoho applications. This makes it especially valuable for businesses that already use Zoho products for inventory management or customer relationships.

Zoho Books handles invoicing with ease. You can create professional invoices quickly and track payments as they come in. The system also sends payment reminders automatically to help improve your cash flow.

The software includes solid tax compliance features. It helps track tax obligations and prepares the necessary reports for filing periods. This can save significant time during tax season.

Banking connections allow for automatic transaction imports. This reduces manual data entry and keeps financial records current with minimal effort.

For very small businesses, Zoho offers a free plan for companies with annual revenue under $50,000. This provides access to core accounting features without cost, making it accessible to startups and solopreneurs.

The paid plans scale up as your business grows. Each tier adds more features and allows more users to access the system. This flexible approach means you only pay for what you need.

Mobile apps make it simple to handle accounting on the go. You can send invoices, record expenses, and check financial reports from your smartphone or tablet.

Customer support gets positive mentions from many users. Zoho provides various support channels and educational resources to help businesses make the most of the software.

7. Patriot Software

Patriot Software offers affordable accounting software designed specifically for small businesses. Their platform focuses on being easy to use while still providing the essential features business owners need.

The company has built a strong reputation in the small business market. They’ve even been named a top small business accounting software, outranking many well-known brands in several categories.

For businesses with tight budgets, Patriot is a worthwhile choice. Their system can handle the basics like contact management, product records, invoices, and estimates without overwhelming users with complex features.

Beyond accounting, Patriot also offers payroll software solutions that have received high rankings from users. According to Capterra, their payroll product ranked first overall based on customer reviews.

Their main website highlights that their software works for businesses with up to 500 employees. This makes it versatile enough for very small startups as well as growing companies with larger teams.

One appealing aspect of Patriot Software is that potential customers can try it for free before committing. This trial period helps business owners determine if the interface and features match their needs.

The company’s focus on simplicity doesn’t mean their software lacks power. They’ve designed their platform to balance user-friendliness with the robust features needed to properly manage business finances.

Small business owners who don’t have accounting backgrounds often appreciate Patriot’s straightforward approach. The learning curve isn’t steep, which means less time figuring out software and more time running the business.

8. Sage Business Cloud Accounting

Sage Business Cloud Accounting offers small businesses a flexible solution for managing their finances. This software makes it easy to create invoices, track cash flow, and record transactions without complex processes.

Small business owners appreciate Sage’s user-friendly interface. The platform allows you to handle basic accounting tasks while providing room to grow as your business expands.

Sage offers multiple versions of its accounting software. While Sage 50 Accounting provides desktop solutions with cloud connectivity, Sage Business Cloud Accounting focuses on cloud-based services for modern businesses.

The software helps with essential financial tasks like invoicing and payment processing. You can also track expenses and monitor your business performance through simple reports.

Compared to other options, Sage may not provide as many customization features. Some users find that it offers fewer advanced tools than competitors, but this simplicity makes it accessible for business owners without accounting expertise.

Sage works well for businesses that need straightforward accounting solutions. The pricing structure allows companies to choose plans that match their specific needs and budget constraints.

The company also offers dedicated small business software solutions beyond just accounting. These include tools for time tracking, billing, and HR management.

For businesses outgrowing basic bookkeeping apps, Sage represents a solid middle-ground option. It provides more features than entry-level software without the complexity of enterprise-level systems.

Customer support options include online resources and direct assistance. This helps new users navigate the platform more confidently when they first get started.

Regular updates keep the software current with tax regulations and business needs. This saves owners from worrying about compliance issues when tax season arrives.

9. Kashoo

Kashoo is a simple accounting software that works well for small business owners. It offers real-time bank feeds and automatic transaction matching to save time on data entry.

The software uses AI to categorize transactions automatically. This means less manual work for business owners who don’t have accounting experience.

Kashoo includes invoicing, expense tracking, and financial reporting in one package. Users can create professional invoices and track when customers pay them.

The mobile app lets business owners manage their finances on the go. They can snap photos of receipts and upload them directly to the system.

Pricing is straightforward with just one main plan that includes all features. This makes it easier for business owners to budget for their accounting software.

Kashoo works well for freelancers and very small businesses that need basic accounting without complicated features. The clean dashboard shows important financial information at a glance.

Customer support gets positive reviews from users. The team offers phone, email, and chat help when questions come up.

The software handles multi-currency transactions, which helps businesses that work with international clients. It also manages sales tax calculations automatically.

Kashoo may not have as many features as some competitors, but its simplicity makes it a good choice for business owners who want to handle their own books without a steep learning curve.

10. ZipBooks

ZipBooks is a cloud-based accounting software designed specifically for small businesses. It stands out by offering both free and paid plans to match different business needs.

The free version includes basic but essential accounting features. Users can create invoices, track expenses, and manage time all without spending a dime. This makes it a good starting point for very small businesses or freelancers.

One notable feature is its simple time tracker. For businesses that bill by the hour, this tool helps capture all billable time efficiently. The software also provides free online invoice examples to help users create professional-looking bills.

ZipBooks works on Mac computers without requiring any downloads. Since it’s web-based, users can access their financial data from any device with internet connection.

According to customer feedback, the platform makes accounting tasks much easier. One user mentioned that it “made accounting, invoicing, and tracking payments a breeze.”

The paid plans offer more advanced features. These include automated customer engagement tools that many traditional accounting programs lack. Such features help businesses maintain good relationships with clients while staying on top of their finances.

ZipBooks also integrates with your bank accounts for easier transaction tracking. This saves time on manual data entry and reduces the risk of errors in financial records.

For those who need to process credit card payments, ZipBooks has built-in functionality. This creates a seamless workflow from invoicing clients to receiving payments.

The software aims to simplify accounting concepts. Its user interface is designed to be intuitive, making it accessible even to those with limited accounting knowledge.

Pricing plans range from free to paid options, allowing businesses to scale their accounting tools as they grow. The flexibility makes it suitable for businesses at different stages of development.

Key Features to Look For

When selecting accounting software for your small business, certain features will make managing your finances easier and more effective. These tools should simplify your accounting tasks while providing the capabilities your business needs now and in the future.

User-Friendly Interface

A user-friendly accounting software is essential for small business owners, especially those without accounting backgrounds. Look for software with:

- Clean, intuitive dashboard layouts

- Simple navigation between functions

- Customizable reports and views

- Clear data visualization (charts and graphs)

- Minimal clicks to complete common tasks

The best accounting software lets you find what you need quickly without hunting through complicated menus. Many providers offer free trials, which you should use to test how easily you can perform daily tasks.

Training requirements matter too. Software with built-in tutorials and good support resources will save you time and frustration. The easier the system is to use, the more likely your team will keep financial records updated and accurate.

Integration Capabilities

Your accounting software shouldn’t exist in isolation. Good accounting solutions connect with other business tools you use daily. Key integration points include:

- Payment processors (PayPal, Stripe, Square)

- Banking institutions for automatic transaction imports

- E-commerce platforms

- CRM systems

- Inventory management tools

- Payroll services

These connections reduce manual data entry and minimize errors. When systems talk to each other, information flows automatically, keeping your books current.

Make sure the software supports importing and exporting data in common formats. This flexibility helps during tax season when sharing information with your accountant. It also makes transitioning from another system much smoother.

Scalability and Growth

As your business grows, your accounting needs will change. Choose software that can grow with your company instead of requiring a complete system change later.

Consider these scalability factors:

- User accounts: How many team members need access?

- Transaction volume: Will it handle increased sales without slowing down?

- Additional modules: Can you add features like inventory or project tracking later?

- Multi-currency support: Important if you plan to expand internationally

- Multiple business entities: Helpful for managing separate locations or divisions

The right software offers tiered pricing plans that let you start with basic features and add more advanced capabilities as needed. This approach prevents overpaying for features you don’t yet need while ensuring they’re available when you do.

Remember that switching systems later can be disruptive and expensive. Investing in scalable software now saves headaches later.

Benefits of Using Accounting Software

Accounting software offers small businesses powerful tools to manage finances better and save resources. These systems simplify complex tasks and provide reliable data when you need it most.

Time and Cost Efficiency

Accounting software saves valuable time by automating repetitive data entry tasks. Once information is entered, the system reuses it across different functions, eliminating the need to type the same details multiple times. This automation reduces hours spent on manual bookkeeping each month.

Small businesses can significantly cut costs by using accounting software. Many affordable options exist with monthly subscription fees that cost less than hiring a part-time bookkeeper. The software also helps prevent expensive errors that might lead to tax penalties or missed opportunities.

Teams spend less time chasing paperwork and more time on growth activities. The software handles routine tasks like:

- Invoice generation and tracking

- Expense categorization

- Bank reconciliation

- Payroll processing

Accurate Financial Reporting

Modern accounting software instantly generates key financial reports that help business owners make informed decisions. These reports provide a clear picture of cash flow, profit margins, and overall financial health at any moment.

The risk of human error decreases dramatically with automated calculations and data entry validation. This accuracy is crucial for tax compliance and financial planning. When numbers are reliable, businesses can spot trends and address issues before they become problems.

Accounting software creates professional reports such as:

- Profit and loss statements

- Balance sheets

- Cash flow analyses

- Budget comparisons

These reports help businesses examine their financial health and make strategic decisions based on real data rather than guesswork.

Frequently Asked Questions

Small business owners have many questions when it comes to choosing accounting software. The right tool can save time, reduce errors, and help make better financial decisions.

What features should the best small business accounting software include?

The best accounting software should include easy invoice creation, expense tracking, and financial reporting. These core features help manage day-to-day finances efficiently.

Tax preparation tools are also essential. Good software will help categorize expenses properly and generate reports needed for tax filing.

Bank reconciliation features save time by matching transactions automatically. This helps catch errors and prevent fraud.

Payroll processing is another key feature for businesses with employees. Thorough research is important before choosing software that meets your specific business needs.

How can free accounting software support a growing small business?

Free accounting software can handle basic bookkeeping tasks like invoicing and expense tracking. This helps new businesses manage finances without adding costs.

As businesses grow, they can often upgrade to paid versions. Many free options offer premium tiers with more features when needed.

Wave Accounting is a popular free option that offers solid features without upfront costs. They make money through payment processing fees instead of software charges.

Free software usually offers cloud storage, meaning you can access your data from anywhere. This flexibility is valuable for growing businesses with changing needs.

Which accounting software do small business owners recommend the most on forums like Reddit?

QuickBooks Online receives frequent mentions in small business forums. Many owners praise its comprehensive features and wide accountant support.

Many accountants recommend QuickBooks specifically, making it easier to work with financial professionals.

Xero has a strong following among tech-savvy business owners. Users appreciate its modern interface and automation capabilities.

FreshBooks gets positive reviews from service-based businesses and freelancers. Its time-tracking and project management features receive particular praise.

Is there a way to securely download free accounting software for small businesses?

Always download software directly from the official website. This ensures you get legitimate software without malware or security risks.

Cloud-based options like Wave don’t require downloads at all. They run in your web browser, reducing security concerns related to downloads.

For desktop software, verify the download by checking the URL and looking for HTTPS encryption. This helps protect your computer and financial data.

Create strong passwords for any accounting software accounts. This simple step significantly improves security for your financial information.

How does Wave Accounting compare to other popular small business accounting tools?

Wave offers completely free accounting features while most competitors charge monthly fees. This makes it especially attractive for very small businesses.

Unlike QuickBooks and Xero, Wave has fewer integration options with other business tools. This might limit its usefulness for businesses with complex needs.

Wave’s invoice and receipt scanning features match those of paid competitors. Users can capture expenses easily using their mobile phones.

The reporting features in Wave are more limited than those in paid options like QuickBooks. However, they cover most basic needs for small businesses.

What are some top-rated accounting software options that cater specifically to small businesses?

QuickBooks Online offers powerful tools tailored for small businesses. Its ecosystem includes payroll, payments, and inventory management.

Xero provides cloud-based accounting with strong collaboration features. It works well for businesses with multiple team members.

FreshBooks excels at service-based business needs. Its time tracking and project management features help businesses bill accurately.

Sage 50cloud combines desktop software reliability with cloud access. This appeals to businesses that want both local control and remote access.