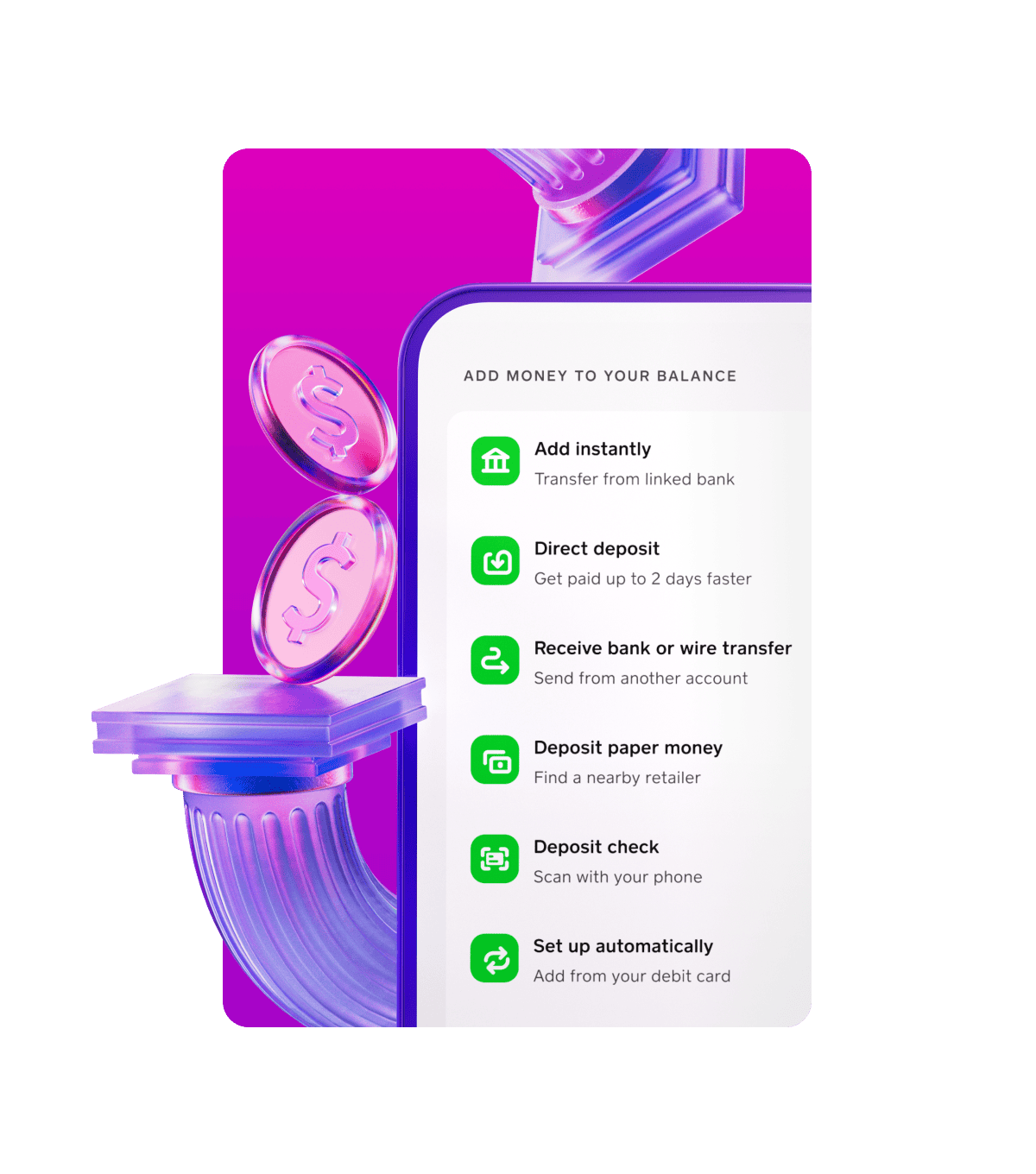

Cash App users have multiple options for adding money to their accounts. You can add funds to your Cash App balance directly through the app, at participating stores, or by linking a bank account. This flexibility makes it easy to keep your Cash App funded and ready for transactions.

Adding money through the app is straightforward. Users can tap the Money tab, select “Add Money,” choose an amount, and confirm with Touch ID or PIN. For those who prefer cash, many stores offer Paper Money deposits. These locations allow users to add up to $1,000 per week and $4,000 per month to their Cash App balance.

Linking a bank account provides another convenient method. Users can transfer funds from their linked account to their Cash App balance quickly and securely. This option is ideal for those who want to move larger amounts or set up regular transfers.

Funding Your Cash App Account

Linking Your Bank Account

Before you can add money to your Cash App, you’ll need to link your bank account. This creates a secure connection between your bank and Cash App, allowing for seamless transfers. Open your Cash App, navigate to the “Money” tab, and follow the prompts to link your account. You’ll typically need to provide your bank’s login credentials or manually enter your account and routing numbers. Once linked, you can easily transfer funds between your bank and Cash App.

Adding Cash with a Debit Card

While linking your bank account is essential for many Cash App features, you can also add money using a debit card. This is a convenient option if you don’t want to link your bank account or need to add funds quickly. Simply enter your debit card information in the “Add Cash” section of the app and specify the amount you want to add. The funds will be transferred to your Cash App balance instantly, allowing you to send money or make payments right away.

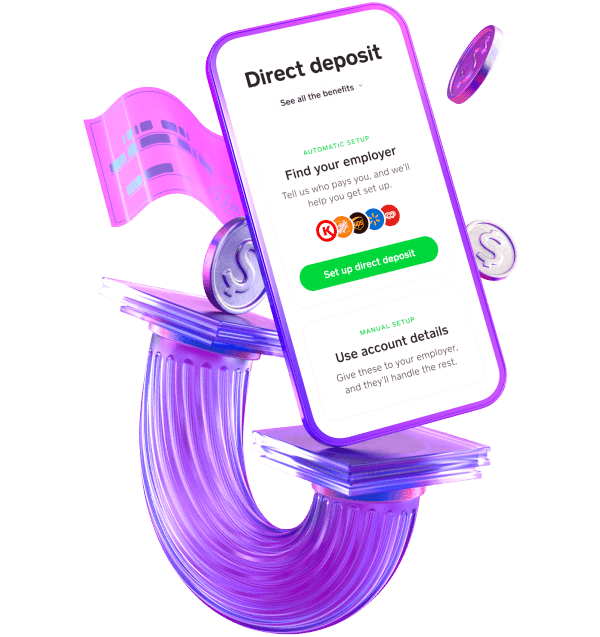

Cash App Direct Deposit

Cash App offers a direct deposit feature that allows you to receive paychecks, tax refunds, and other payments directly into your Cash App balance. This eliminates the need to wait for checks to clear or manually transfer funds. To set up direct deposit, you’ll need your Cash App routing and account numbers, which you can find in the “Money” tab. Provide this information to your employer or the payer, and they can initiate the direct deposit. Funds typically arrive within 1-2 business days.

Retail Partners

Cash App has partnered with a network of retail stores, including Walmart, Walgreens, CVS, and 7-Eleven, to offer cash loading services. This is a useful option if you prefer to add cash in person or don’t have a bank account or debit card. Open the Cash App and tap “Paper Money” to find a participating store near you. At the store, tell the cashier you want to add money to your Cash App and provide your account information, usually your phone number. Hand them the cash, and they’ll add it to your Cash App balance.

Adding Cash at Retail Partners: Step-by-Step

While the previous section mentioned some major retailers, here’s a more detailed breakdown of how to add money to your Cash App at participating stores:

- Locate a store: Open your Cash App, go to the “Money” tab, and tap “Paper Money.” This will show you a map of nearby stores that offer Cash App reloading. You can also use the “Find a Store” feature on the Cash App website to search for locations by address or ZIP code.

- Visit the store: Head to the customer service desk or cashier counter at the participating store.

- Inform the cashier: Let the cashier know you want to add money to your Cash App.

- Provide your Cash App information: You’ll usually need to provide your phone number associated with your Cash App account. Some stores may also ask for your \$Cashtag (your unique Cash App username).

- Present your cash: Give the cashier the amount of cash you want to add to your Cash App balance.

- Confirm the transaction: The cashier will process the transaction and add the money to your Cash App account. Be sure to keep the receipt as proof of payment.

Tips for a Smooth Transaction:

- Have your Cash App account information ready: To speed up the process, have your phone number or \$Cashtag readily available.

- Bring exact cash: Some stores may not be able to provide change for large bills.

- Be aware of fees: Some retailers may charge a small fee for this service. Inquire about any potential fees before completing the transaction.

- Verify the transaction: Before leaving the store, check your Cash App balance to confirm that the funds have been added successfully.

Remember:

- Retailer participation may vary: Not all stores listed on the Cash App map may offer this service. It’s a good idea to call ahead to confirm.

- Limits may apply: There might be limits on the amount of cash you can add at retail locations.

Methods For Adding Money to Cash App

| Method | Speed | Fees | Limits | Convenience |

|---|---|---|---|---|

| Bank transfer | Instant | None | Varies by bank | High |

| Debit Card | Instant | None | Varies by card issuer | High |

| Retail locations | Instant | Varies | Usually up to $500 | Moderate |

| Direct deposit | 1-2 business days | None | Up to $25,000 per deposit | High (recurring) |

Important Notes:

- Retailers may charge a small fee for adding cash to your Cash App.

- Direct deposits may take a few business days to process.

- Always double-check that you’re providing your Cash App information to authorized personnel at retail locations.

- Cash App limits the amount of money you can add and spend, so be sure to review their terms and conditions.

Key Takeaways

- Cash App offers in-app, store, and bank transfer options for adding funds

- Store deposits have limits of $1,000 weekly and $4,000 monthly

- Linking a bank account allows for quick and secure fund transfers

Adding Funds to Your Cash App

Cash App offers several convenient methods to add money to your account. These options cater to different user needs and preferences.

Direct Deposit and Bank Transfers

Users can link their bank accounts to Cash App for easy fund transfers. To add money, open the app and tap the Banking tab. Select “Add Cash” and enter the amount you want to transfer. Confirm the transaction with your PIN or Touch ID.

Bank transfers are usually free and take 1-3 business days. For faster transfers, some banks offer instant deposits for a small fee. Direct deposit is another option. Users can set up their Cash App account to receive paychecks or government payments directly.

Using Cash Cards and ATMs

The Cash Card is a free debit card linked to your Cash App balance. You can use it to withdraw money from ATMs or make purchases. To add funds, visit any ATM that accepts Visa cards. Insert your Cash Card, choose “Deposit,” and follow the on-screen steps.

Some ATMs may charge a fee for deposits. Cash App reimburses up to $7 in ATM fees per month for users who receive $300+ in direct deposits.

In-Store Deposits at Partner Retailers

Cash App partners with many stores for paper money deposits. Popular options include:

- Walmart

- Walgreens

- 7-Eleven

- Family Dollar

- Rite Aid

To deposit cash, open Cash App and tap “Paper Money” in the Banking tab. This shows a map of nearby deposit locations. At the store, show the cashier your deposit barcode and hand over the cash. You’ll get a receipt for the transaction.

Understanding Deposit Limits and Timing

Cash App has limits on how much you can deposit. For paper money deposits:

- Minimum: $5 per transaction

- Maximum: $500 per deposit

- Weekly limit: $1,000 (rolling 7 days)

- Monthly limit: $4,000 (rolling 30 days)

Bank transfers and direct deposits have higher limits. These can vary based on your account status and verification level. Most deposits are instant or process within 1-3 business days. Cash App may hold some funds for security reasons.

Paper Money Deposit

You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. This fee is automatically collected from the funds that you are depositing.

Deposit Locations

Paper Money Deposits are currently supported at the following merchants:

- 7 Eleven

- Baker’s

- Bashas’

- City Market

- Circle K

- Cox Foodarama

- CVS Pharmacy

- Delek

- Dillons

- Dollar General

- Duane Reade (displays as Walgreens on the map)

- EZ Mart

- Family Dollar

- Food 4 Less

- Foods Co

- Fred Meyer

- Fry’s

- Gerbes

- GoMart

- H-E-B

- Holiday Station

- Huck’s

- Jacksons

- Jay C Food Store

- King Soopers

- Kroger

- Kwik Check Foods

- KwikTrip

- Kum & Go

- Mariano’s

- Metro Market

- Pay-Less Super Markets

- Pick’n Save

- Pilot Travel Centers

- QFC

- Ralphs

- Rite Aid

- Royal Farms

- Ruler

- SaveMart

- Sheetz

- Smith’s Food and Drug

- Speedway

- Thorntons

- TravelCenters of America

- Walgreens

- Walmart*

- Wesco

- Yesway

*For deposits at Walmart, see your store’s customer service desk or MoneyCenter. Please note that the hours of operation for these services may differ from the store’s general hours of operation.

Find a Location

Use the map in the Paper Money section of your Banking tab to find a deposit location near you. To do so:

- Tap the Banking tab on your Cash App home screen

- Select Paper Money

- Find a location near you or use the search bar to enter an address

Once you’ve found a convenient location, use the options to get directions or copy the address into your preferred navigation app.

Merchants and Cashiers

When you arrive at the store, inform the cashier that you would like to load funds onto your Cash App using your barcode. If they are unsure how to assist you, you can show them the instructions by tapping the question mark on your map. Once the cashier scans the barcode from your Cash App, provide them with the cash you wish to deposit. The funds will automatically be added to your Cash App balance. It is recommended that you keep a copy of your receipt from the cashier.Some merchants may require you to swipe your Cash Card to complete the Paper Money deposit.

However, it is important to note that the barcode must be scanned in order to initiate the deposit transaction. If the cashier asks to swipe or insert your card for the deposit, remind them to scan the barcode instead.With Cash App, you can deposit up to $1,000 every rolling 7 days and up to $4,000 every rolling 30 days. Each transaction must be a minimum of $5 and cannot exceed $500 per deposit. The 7-day and 30-day limits are based on a rolling timeframe. If you reach a deposit limit, you will receive a notification with further information.Additionally, some merchants may request your ID as an extra verification step when you deposit cash. Since your Paper Cash deposit occurs at a store, please adhere to any policies that the location may have in place.