Choosing between Monarch Money and Quicken (including Simplifi by Quicken) comes down to what kind of financial life you lead—and what kind of control you want over it. Both platforms are among the most powerful personal finance tools in 2025, but they cater to different users. Monarch appeals to people looking for a sleek, modern budgeting experience with powerful collaboration features. Quicken, on the other hand, continues to serve users with complex financial portfolios, from investment tracking to rental property management.

Here’s a head-to-head breakdown to help you make the best choice for your finances this year.

Monarch Money: Clean, Collaborative, and Goal-Oriented

Why Users Love It

Monarch Money is designed with a modern UI that focuses on simplicity, visual feedback, and goal-based budgeting. It’s a great fit for couples, families, and individuals who want more visibility into their finances without getting buried in spreadsheets.

Key Features:

- Real-Time Budgeting: Monarch syncs with your accounts in real-time, providing a clear picture of income, expenses, and budget targets.

- Customizable Goals: Users can create unlimited savings or debt goals, track progress visually, and allocate funds with precision.

- Net Worth Tracking: Includes interactive charts to track changes in net worth across accounts and asset categories.

- Collaborative Accounts: Allows multiple users to manage shared finances—ideal for households or partners.

- Frequent Updates: Monarch is constantly adding features, such as bill tracking, investment overviews, and even iPad-specific UI improvements.

User Experience:

The interface feels like a modern-day Mint with less clutter and better long-term vision. It’s especially popular among ex-Mint users looking for a worthy replacement after that service’s sunset.

Pricing:

- $14.99/month or $99.99/year

- 7-day free trial available

- Promo code MONARCHVIP for 50% off the first year

Limitations:

- No free version after the trial

- Customer support is only available via email

- Investment tracking is present, but lacks the depth of Quicken

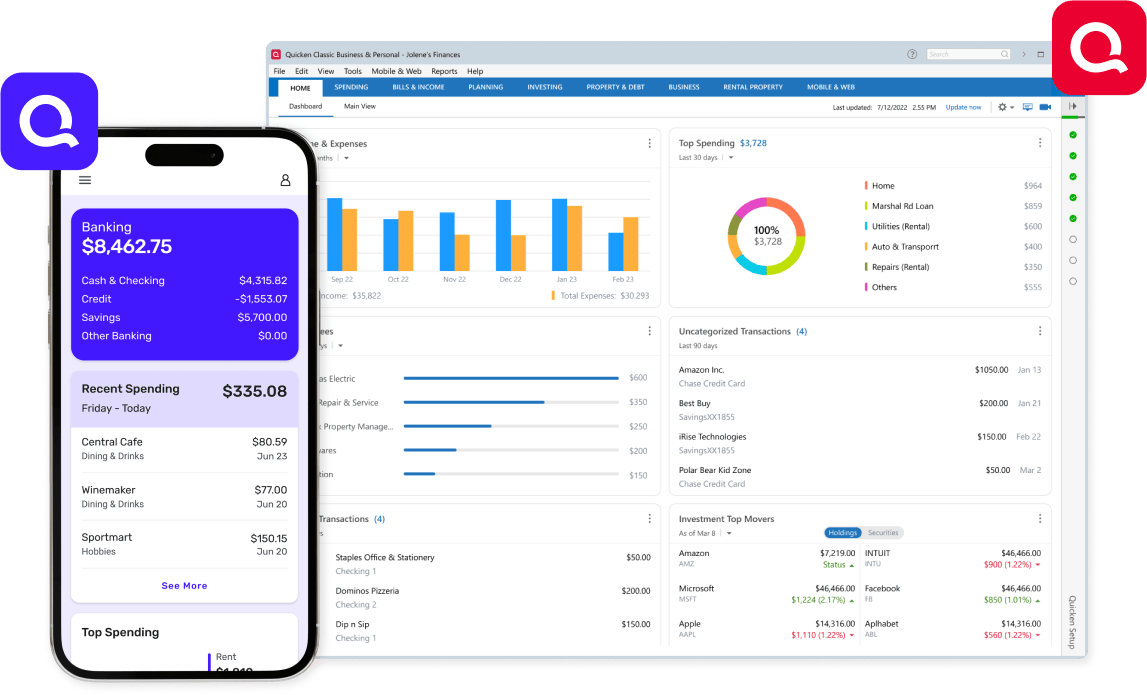

Quicken & Simplifi: For Power Users and Detailed Financial Tracking

Why It’s Still a Contender

Quicken has been around for decades, and while its legacy desktop app may feel outdated to some, its capabilities are unmatched when it comes to in-depth reporting, investment performance, and asset tracking. For those wanting a simpler, more modern option, Simplifi by Quicken offers a streamlined alternative.

Key Features (Quicken Classic):

- Advanced Investment Management: Track portfolios, capital gains, dividends, and retirement projections.

- Bill Payment Integration: Some versions allow you to pay bills directly within the app.

- Property & Business Tools: Manage rental income, expenses, tenants, and even small business cash flow.

- Local Storage Option: Quicken allows full offline use—a unique offering in a cloud-first world.

Key Features (Simplifi):

- Cash Flow Forecasting: Project future balances based on recurring expenses and income.

- Spending Plan: Helps users avoid overspending by categorizing all expenses and comparing against set limits.

- Modern Interface: Built from the ground up for mobile and web users with faster sync and intuitive navigation.

Pricing:

- Simplifi: $71.88/year (no trial, but has a 30-day money-back guarantee)

- Quicken Classic: Ranges from $35.99 to $93.59/year depending on tier

Support and Concerns:

- Phone and chat support available for Simplifi

- Desktop Quicken has had customer support complaints and the parent company holds a poor BBB rating (F)

- Simplifi no longer offers a free trial

Who Should Use What?

| Feature | Monarch Money | Quicken / Simplifi |

|---|---|---|

| Interface | Sleek, modern, mobile-first | Traditional for Quicken; modern for Simplifi |

| Budgeting | Goal-based, collaborative | Detailed, transaction-level |

| Investment Tracking | Basic | Deep (especially in Quicken Classic) |

| Multi-user Access | Yes | No |

| Business/Rental Features | No | Yes (Quicken Classic only) |

| Customer Support | Email only | Phone and chat for Simplifi |

| Offline Access | No | Yes (Quicken Classic) |

| Price (Annual) | $99.99 (Monarch) | $71.88 (Simplifi), $35.99–$93.59 (Quicken) |

Verdict: Which Is Right for You?

- Choose Monarch if you want a smart, visual, collaborative budgeting tool that’s great for individuals or households focused on goals and net worth tracking. It’s especially appealing for those looking to escape outdated legacy apps without giving up control.

- Go with Quicken Classic if you’re managing investments, rental properties, or small business finances and need powerful reporting tools—especially offline access.

- Opt for Simplifi if you like the Quicken brand but want something built for mobile that’s easier to use, with solid cash flow forecasting and strong support.

Whichever you choose, both platforms remain strong alternatives to Mint, YNAB, and Personal Capital, offering a mix of automation and insight in a world where financial literacy and control are more important than ever.

Key Takeaways

- Monarch focuses on a simple interface and strong budgeting.

- Quicken offers more detailed financial management tools.

- The best choice depends on budget and feature priorities.

Core Features Comparison

Monarch and Quicken both help users organize their finances, but each program offers different tools, approaches, and strengths. Their main differences show most in budgeting features, the way they handle financial planning, and their investment and net worth tracking.

Overview of Monarch and Quicken

Monarch Money is a web-based tool that focuses on easy navigation and clean design. It pulls financial data from banks, credit cards, and loans, then puts it all in one place. Monarch has a user-friendly dashboard that displays account balances, recent transactions, and budgets right away.

Quicken has been around for several decades. It offers a more traditional set of personal finance tools. Its desktop version provides extensive features, while Quicken Simplifi is its web-based version. Quicken can feel complex, but users get robust account management options for almost any financial need.

Both apps keep user data secure with encryption. Monarch supports most major financial institutions. Quicken connects to a wide range of account types, including investment accounts and retirement plans.

Budgeting and Financial Planning Tools

Monarch Money uses a category-based budgeting approach. Users set spending targets for each category—like groceries, rent, or utilities—and track progress in real time. Monarch gives instant feedback, so users see where they stand every day. It highlights current spending patterns and lets people see trends.

Quicken offers several ways to create a budget. Users can set up detailed monthly budgets, life event planning, and even create future spending projections. Budgeting tools include customizable categories, expense breakdowns, and cash flow forecasting. The desktop version has more advanced planning features while Simplifi is more streamlined.

Monarch’s budgeting system is easier for beginners. Quicken’s is more detailed and can handle complex financial situations. Both let users track bills, create savings goals, and see how much they spend over time. For more details, see this comparison of Monarch vs Quicken.

Investment and Net Worth Tracking

Monarch Money tracks net worth by linking bank accounts, loans, credit cards, and investments. It updates account values automatically, giving a real-time look at total assets and debts. Monarch’s investment tracking is simple; it shows balances, recent activity, and allocation by asset class.

Quicken provides deeper investment management options. It supports detailed reporting, custom asset allocation, and capital gains tracking. Users can view performance metrics, dividend income, and even tax implications of trades. Quicken is more suitable for those with complex investment portfolios or multiple brokerage accounts.

Both Monarch and Quicken track net worth over time, but Quicken’s long history gives it more reporting features. Users needing detailed investment analysis may prefer Quicken, but those wanting a simple way to see their progress may find Monarch fits better. For more direct side-by-side details, see this Monarch vs Quicken comparison.

User Experience and Interface

Both Monarch and Quicken focus on making personal finance easier to manage by offering clear interfaces and practical features. Each tool handles account setup, navigation, and transaction tracking in its own way, shaping how users interact with their money.

Mobile App and Web Platforms

Monarch provides a modern, clean design both on its mobile app and web platform. The interface is uncluttered, which makes for quick navigation and easy viewing of budgets or transactions. Monarch’s mobile app scores high in app store reviews for its stability and responsive layout.

Quicken, especially through its Simplifi product, offers a similar suite of mobile and web tools. The app also aims for a straightforward experience, but some users notice Quicken’s design feels more traditional. On mobile devices, both platforms sync data in near real-time across accounts, so users always see up-to-date information.

Monarch tends to be rated as a bit easier to use on mobile. Users highlight how they can customize dashboards and move smoothly between features. For those who often manage their finances on the go, Monarch’s mobile app and web tools often stand out as the more seamless option in direct comparison.

Usability and Onboarding Process

Monarch’s onboarding moves quickly. Users connect bank and credit accounts, pick budget categories, and import transactions without many steps. The interface uses visual prompts and short guides to walk newcomers through setup. Within minutes, most users can see an overview of their finances.

Quicken introduces a few more steps before users start tracking their money. Setting up accounts and budgets takes slightly longer, especially for users unfamiliar with more robust desktop finance software. Quicken’s menus and navigation might require an adjustment period, especially for first-time users.

Monarch’s guided walkthrough and focused prompts reduce friction for new users. Many who switch from Quicken say Monarch’s onboarding is less overwhelming and more intuitive, which helps them start budgeting faster. Those who prefer detailed customization, though, might feel more at home with Quicken’s in-depth options.

Auto-Categorization and Transaction Tracking

Both Monarch and Quicken use auto-categorization to sort spending and income, so users spend less time labeling transactions. Monarch’s algorithms learn quickly and can be edited if they misclassify an item. Users report the system improves as they correct categories, which saves them time later.

Quicken also provides solid auto-categorization, but some users report manual changes are needed more often, especially with unique or irregular transactions. Both apps allow users to review recent transactions in a clear list with options to make corrections as needed.

Monarch’s transaction tracker is praised for being straightforward. It highlights spending trends, lets users search for past transactions, and creates simple summaries. Quicken’s tracker offers more reporting features and deeper analytics, which helps those who want detailed transaction history or custom reports.

For users who want fast, accurate tracking of their spending, Monarch holds a slight edge due to its simplicity and learning auto-categorization. For those who need more advanced reporting, Quicken still offers useful tools, though it may take more setup. For more details, see this direct comparison of Monarch and Quicken.

Financial Data Integration and Security

Managing money with Monarch or Quicken depends on how well each pulls in financial accounts, handles outside connections, and protects user data. Features that cover account linking, integration options, and safety measures can shape everyday use for both beginners and experienced users.

Bank and Account Connectivity

Monarch and Quicken both let users connect a wide range of financial accounts, including checking, savings, investment, and credit card accounts. They work with providers like Plaid and MX to help pull in account balances, transactions, and other financial data. Account syncing usually happens automatically.

Monarch uses clean, modern account dashboards that are known for simplicity. Users can easily see real-time updates as accounts sync. Quicken, a more established tool, pulls in similar information but sometimes needs manual refreshes for certain banks.

In direct comparisons, Monarch is praised for making it easy for even new users to link accounts. Quicken supports more account types, including some less common investment and loan accounts. More details on these differences can be found on the Monarch vs Quicken comparison.

Third-Party Integrations and Data Handling

Both products rely on third-party integrations like Plaid and MX for retrieving data from external accounts. Monarch often highlights its fast syncing and up-to-date balances. Quicken, due to its longer history, sometimes supports direct connections to certain banks for extra functions, such as bill pay.

Monarch focuses on simplicity, keeping outside integrations limited to what most users need, avoiding excess clutter. Quicken, in contrast, allows connections with additional tools for taxes and investments. This flexibility works well for complex needs but can add setup steps.

Data from third parties is encrypted and flows securely to the main dashboard. Users can see a unified view of all linked accounts and can export reports if needed. Practical examples and side-by-side reviews are available on the Monarch versus Quicken platform.

Security Features and Privacy

Monarch and Quicken both use established encryption standards to keep personal and financial data safe during transfer and storage. Multi-factor authentication (MFA) is an option on both platforms, adding an extra layer of protection during login.

Both products make use of secure connections when pulling data from Plaid or MX, so account credentials are not shared directly with the app. Users can manage privacy options from within their settings and can disconnect accounts at any time.

Monarch’s privacy and security policies are simple and designed for easy reading. Quicken, having served millions of users, maintains more detailed documentation and larger-scale support in case of questions or security incidents. Each tool gives users ways to control and monitor access to their financial information.

Budgeting and Money Management Capabilities

Monarch and Quicken focus on helping users organize their finances, track income, and manage expenses. Each budgeting app takes a different approach to how it handles spending categories, recurring bills, and savings features, which can impact budgeting strategies.

Spending Categories and Cash Flow

Monarch automatically sorts transactions into spending categories, giving users a clear view of where money goes. This helps identify overspending and unusual expenses fast. It supports both simple overviews and more detailed budget breakdowns.

Quicken works with a similar system, but it offers more customization. Users can rename, add, or merge categories to fit their budget style. Quicken lets users use zero-based budgeting, while Monarch focuses on flexibility and ease for beginners.

Both apps help track cash flow by showing total income and expenses. Monarch presents this with clean graphs and summaries. Quicken provides detailed reports and projections. Users who need granular control may prefer Quicken’s tools, but Monarch keeps it straightforward for those new to personal finance.

Recurring Bills and Expense Tracking

Monarch tracks recurring bills and subscriptions in its dashboard. Users get alerts for upcoming charges, helping them avoid missed payments and late fees. The app makes it easy to spot trends and find areas for spending cuts.

Quicken has an extensive bill management system. Users can view, edit, and forecast upcoming bills. Quicken can even connect directly with some billers to confirm amounts and due dates.

Both budgeting apps flag duplicate expenses and split transactions. Monarch relies on automation for setup, while Quicken offers manual tools for experienced users who want more control. For families or couples, Monarch supports shared budgeting, making it easy to track joint expenses.

Savings Goals and Debt Management

Monarch includes tools for setting savings goals. Users track progress, automate contributions, and see how saving affects their cash flow. Visual charts make goal status clear. The app also supports tracking debt balances, though features are basic.

Quicken has stronger debt payoff tools. Users can set up payoff plans for loans and credit cards. The software projects payoff dates and interest saved, helping users manage debt reduction.

Both budgeting apps support linking outside savings accounts. Monarch focuses on flexible goals for vacations, emergencies, or big purchases. Quicken’s personal finance app provides more detailed options for targeting multiple debts or savings priorities. Those serious about paying down debt may find Quicken’s tools more comprehensive (compare more here).

Monarch vs Quicken: Unique Advantages

Monarch and Quicken each offer distinct benefits that can matter depending on how you manage your money. Users must weigh cost, feature support, and how each company treats their customers to pick the best fit.

Pricing and Plan Options

Monarch Money and Quicken have different subscription plans. Monarch charges more per year but includes goal tracking, net worth tools, and a modern interface. It’s a strong choice for those looking for a Mint alternative with budgeting focus.

Quicken offers two products: Quicken Classic (desktop-based) and Simplifi by Quicken (web/mobile). Quicken Simplifi is around $71.88 per year, which is less than Monarch. None of the best budgeting apps in this comparison have free options. Quicken Classic gives more advanced investment tracking and bill management. Monarch fits users who mainly want budgeting and simple net worth tracking.

A quick comparison:

| Feature | Monarch | Quicken Simplifi | Quicken Classic |

|---|---|---|---|

| Annual Price | Higher | Lower | Varies |

| Goal Setting | Yes | Yes | Yes |

| Investment Tracking | Basic | Basic | Advanced |

| Free Version | No | No | No |

Customer Support and Community

Quicken, being one of the oldest budgeting tools, has a large user community. Users find many support articles, videos, and active forums. Quicken support offers live chat and phone support for subscribers. This is valuable if you want human help when problems come up.

Monarch has less history, so its community is smaller. Still, it has an up-to-date help center and email support. Many reviews mention that Monarch’s design makes it easy for beginners to pick up. Some users on NerdWallet report it is easier to get started with Monarch than with Quicken. However, advanced users may find Monarch’s resources limited compared to Quicken.

Quicken caters better to complex needs and those who value a robust support system. Monarch is suitable for those who prefer a modern experience and need less hands-on help.

Alternative Solutions and Related Platforms

Several apps and services offer budgeting tools beyond Monarch and Quicken. They differ in pricing, features, and how they handle your data and offer tailored spending plans.

Simplifi, YNAB, and Other Competitors

Quicken Simplifi is known for lower costs than Monarch, with features such as personalized spending plans and cash flow projections. Users can make quick spending reports and set up goal tracking easily. For more details, check the comparison between Quicken Simplifi and Monarch Money.

YNAB (You Need A Budget) helps users assign each dollar a job, encouraging planning for every expense. Its zero-based budgeting helps people save and pay off debt. Empower and Rocket Money offer similar bank account tracking and budgeting tools. PocketGuard provides a clear “in my pocket” number to prevent overspending.

Here is a simple table comparing key competitors:

| Platform | Spending Plans | Cash Flow | Account Sync | Cost |

|---|---|---|---|---|

| Simplifi | Yes | Yes | Yes | $ |

| YNAB | Yes | No | Yes | $$ |

| Empower | Yes | Yes | Yes | $ |

| PocketGuard | Basic | No | Yes | Free+ |

Special Features: Credit Score Monitoring and Financial Advice

Some apps offer features beyond budgeting. Credit Karma and Rocket Money allow users to monitor their credit score any time for free. People can get alerts if something on their credit report changes. This helps prevent fraud.

Empower and some other tools connect users with a financial advisor for extra guidance. This advice supports long-term planning, retirement, or investing. Tailored plans give users a better picture of where their money is going and help reduce financial stress.

Credit score access and continuous updates are important for those building or repairing credit. These features, plus support from a financial advisor, can make a big difference in reaching financial goals.

Frequently Asked Questions

Monarch and Quicken serve users looking to track spending, set budgets, and measure net worth. They differ in features, pricing, and user experience.

What are the main differences between Monarch and Quicken Deluxe?

Monarch Money focuses on simple budgeting, clear goal tracking, and modern web and mobile apps. It targets users who want flexibility and ease of use.

Quicken Deluxe offers broader financial planning, investment tracking, and more robust reporting tools. Quicken is a desktop-first application but also offers some cloud syncing.

How does the cost of Monarch compare to Quicken?

Monarch follows a subscription model, usually offering a monthly or annual plan. Quicken Deluxe requires an annual subscription, and prices vary based on the features.

Simplifi by Quicken costs less than Monarch in many cases, while Quicken Deluxe may cost more, depending on the plan. For a side-by-side price analysis, see this breakdown at Quicken Simplifi vs Monarch.

What features distinguish Monarch from Quicken Simplifi?

Monarch allows users to build custom budgets, track net worth, and set financial goals. It has two main budgeting modes that users can switch between, which is not found in Quicken Simplifi.

Quicken Simplifi has a single method for organizing budgets but also includes cash flow forecasts and reports. More details can be found in the comparison from WalletHub.

How do user experiences vary between Monarch and Quicken according to Reddit discussions?

On Reddit, some people note that Monarch’s interface feels more modern and easier to use, especially for people who like simple budgeting. Others say Quicken offers deeper financial tracking and analysis but feels outdated in style.

A discussion of real users’ experiences is available in this Reddit thread.

What has Quicken been renamed to, and how does it affect comparison with Monarch?

Quicken’s main desktop product is still called Quicken. However, they now offer a web-based version called Simplifi by Quicken. This adds a direct competitor to Monarch in the online budgeting space.

The added Simplifi version makes it important to distinguish between Quicken Deluxe and Quicken Simplifi when evaluating against Monarch.

How does Monarch’s budgeting tools stack up against those available in Quicken?

Monarch offers customizable budget templates and goals, making it easier for users who want to track by category and time period.

Quicken, on the other hand, gives more depth in tracking investments and bill reminders, along with advanced reporting. Monarch aims for simplicity and a cleaner user experience, while Quicken offers more features for detailed tracking.