Learning how to use QuickBooks is an essential skill for anyone involved in small business bookkeeping. This accounting software simplifies tracking expenses, creating invoices, and managing financial statements, making it a valuable tool for business owners and bookkeepers alike. With a user-friendly interface, QuickBooks is designed to make financial management accessible, even for those new to accounting principles.

While QuickBooks is aimed at small businesses, its capabilities are quite comprehensive. It supports a wide range of accounting tasks from simple income and expense tracking to complex reporting and payroll management. Beginners can benefit from numerous online resources that provide step-by-step guidance through the basics of setting up and getting started with the software.

1. Choose the Right Version

QuickBooks comes in several editions. The most common are:

- QuickBooks Online (QBO): Cloud-based, accessible anywhere, subscription-based.

- QuickBooks Desktop (Pro, Premier, Enterprise): Installed software, more advanced features, but less flexible than QBO.

👉 For most beginners, QuickBooks Online is the easiest to start with (source: Tech.co).

2. Set Up Your Account

- Sign up for QuickBooks Online.

- Enter your business details (name, type, industry, and tax info).

- Customize your settings:

- Choose your fiscal year.

- Set up your chart of accounts (categories for income, expenses, assets, and liabilities).

- Add your business logo and branding for invoices.

3. Connect Your Bank & Credit Cards

QuickBooks allows you to link your bank accounts so transactions flow in automatically.

- This saves hours of manual data entry.

- You can categorize expenses as they appear (e.g., office supplies, utilities, meals).

4. Learn the Dashboard

The QuickBooks dashboard gives you a snapshot of your business health:

- Profit & Loss: Tracks income vs. expenses.

- Expenses: Shows spending categories.

- Invoices: Displays unpaid and overdue invoices.

- Bank balances: Matches your connected accounts.

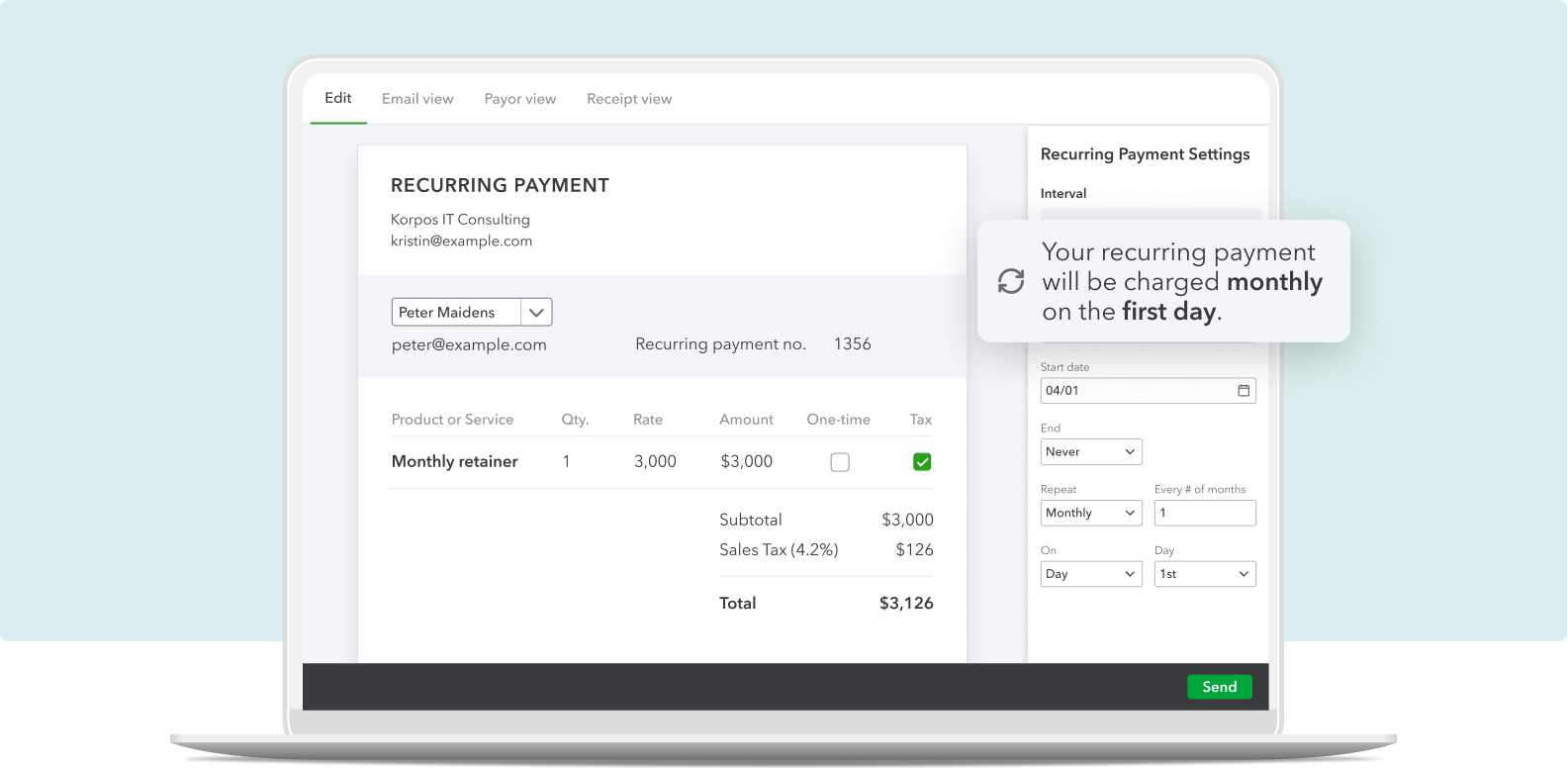

5. Manage Invoices & Payments

- Create professional invoices and send them directly to clients.

- Enable online payments so customers can pay by card or ACH.

- Track overdue invoices and send reminders.

6. Track Expenses & Bills

- Upload receipts or snap photos with the QuickBooks mobile app.

- Categorize expenses for tax deductions.

- Enter bills from vendors and schedule payments.

7. Run Payroll (Optional)

If you have employees:

- Use QuickBooks Payroll to calculate wages, taxes, and direct deposits.

- File payroll taxes automatically.

8. Generate Reports

QuickBooks makes reporting easy:

- Profit & Loss Statement (income vs. expenses).

- Balance Sheet (assets, liabilities, equity).

- Cash Flow Statement (money in vs. money out).

These reports help you understand your business performance and prepare for tax season.

9. Reconcile Your Accounts

Reconciliation ensures QuickBooks matches your bank statements.

- Do this monthly to catch errors or missing transactions.

- Helps keep your books accurate for taxes and audits.

10. Get Help When Needed

- Use QuickBooks’ built-in tutorials and help center.

- Watch beginner walkthroughs on YouTube (e.g., QuickBooks Online tutorial).

- Consider working with a bookkeeper if things get complex.

Final Tips for Beginners

- Start simple—track income and expenses first, then explore advanced features.

- Keep your books updated weekly to avoid year-end stress.

- Back up your data (if using Desktop).

- Stay consistent with categorization for clean financial reports.

✅ With these steps, you’ll be able to confidently manage your business finances in QuickBooks, save time, and make smarter financial decisions.

Key Takeaways

- QuickBooks aids in simplifying financial tasks for small businesses.

- The software is user-friendly for beginners in bookkeeping.

- Online resources are available for learning QuickBooks effectively.

Getting Started with QuickBooks

Starting with QuickBooks involves a few essential steps that streamline your financial management. Understanding the layout of the program, setting up your business details, tweaking the settings to fit your needs, and organizing your financial structure are key.

Understanding the QuickBooks Interface

QuickBooks offers a user-friendly interface making it easier for new users to navigate. It is designed with a dashboard that provides a snapshot of your financial status. Key areas such as sales, expenses, and reports are accessible with just a click. The layout is intuitive, with a side menu to reach different sections like sales, expenses, and banking.

Setting Up Your Company File

Your company file is where all your business data lives. Here, you include the company’s name, address, tax information, and start date. For QuickBooks Online users, this setup is crucial for accessing the software’s features. QuickBooks Desktop and QuickBooks Self-Employed users also follow a similar process for an accurate financial picture.

Customizing QuickBooks Settings

Customization allows QuickBooks to suit your specific business operations. You can set preferences for invoicing, payments, expenses, and accounting methods. Bookkeepers can avoid future complications by getting these settings right from the start. This step ensures that your data works for you in the most efficient way.

Creating Your Chart of Accounts

The chart of accounts is the backbone of your financial record-keeping. It lists all your business accounts and classifies them into assets, liabilities, income, and expenses. This organization helps in tracking every transaction. With QuickBooks Tutorials, you can learn how to set up and manage your chart of accounts effectively. Creating a logical and comprehensive chart is crucial for accurate financial reporting.

Getting started with QuickBooks doesn’t have to be overwhelming. Following these steps can help you build a solid foundation for your business accounting needs. With a clear understanding of the essentials, you’re on your way to efficient financial management.